Integral Insight: October ‘23

Nov 6, 2023

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.

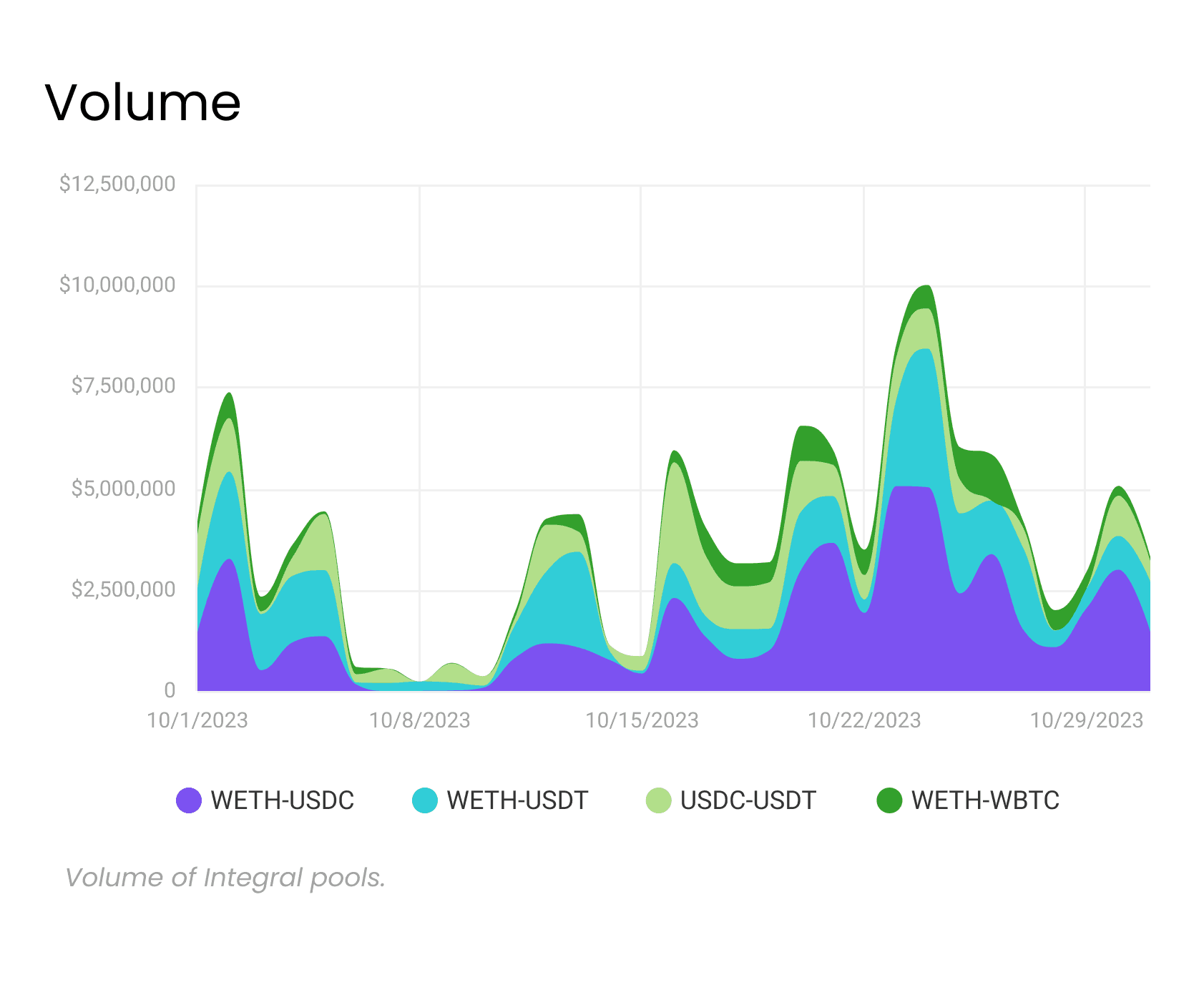

October has been an electrifying month at Integral, setting new records for volume amid a volatile and exciting month for crypto. Here’s a rundown of our updates from the month:

Record-Breaking Volumes During Uptober

The crypto market experienced substantial gains in major assets, and Integral rode this wave, recording exceptional trading volumes across our listed pairs. We hit our highest single-day trading volume ever at $10 million, and the weekly volume peaked at an unprecedented $44 million.

Revamping Fee Distribution and LP Rewards

We are committed to rewarding our Liquidity Providers (LPs) and have initiated a revamp of the distribution of fees and rewards. The changes include a new approach to distributing trading fees and arbitrary ERC20 token (coming soon) to LPs, ensuring a fairer and more beneficial structure for all involved. Dive deeper into these changes in our dedicated blog posts.

Engaging with the Community Through Office Hours

We have moved to hosting office hours on X/Twitter Spaces. If you haven’t had the chance to join us, make sure to catch up and stay tuned for the next session. You can even get some on chain rewards for participating. It’s a great opportunity to learn more about Integral and ask any questions you might have.

Research and Insights from Our Team

Our research team has been prolific, releasing blog posts discussing the hottest narratives from this summer and the latest controversy around Lido. Additionally, we’ve delved into governance research with an insightful postabout Uniswap governance.

Spotlight on a Long-Term LP: A Success Story

We’d like to highlight an inspiring story from our community. A Liquidity Provider, with the EOA: 0xA549, demonstrating the power of long-term focus and the potential rewards of participating in Integral’s liquidity pools.

This LP was part of Integral FIVE and also engaged in trading activities on the platform a while back. They maintained their position in the pool for exactly one year, depositing on Oct 27, 2022, and withdrawing on Oct 27, 2023. Their initial deposit was made up of 161.9k USDC and 123.5 WETH, valued around 349k USD at the time, given the ETH price of 1514 USD.

A year later, they withdrew 271.6k USDC and 171.5 WETH, with ETH priced at 1787 USD, totaling an impressive 578k USD in value.

This story is an example of the potential benefits of being a long-term-focused LP in the Integral ecosystem. Although this is one data point, it serves as an encouraging testament to the strength and stability of our LP system.

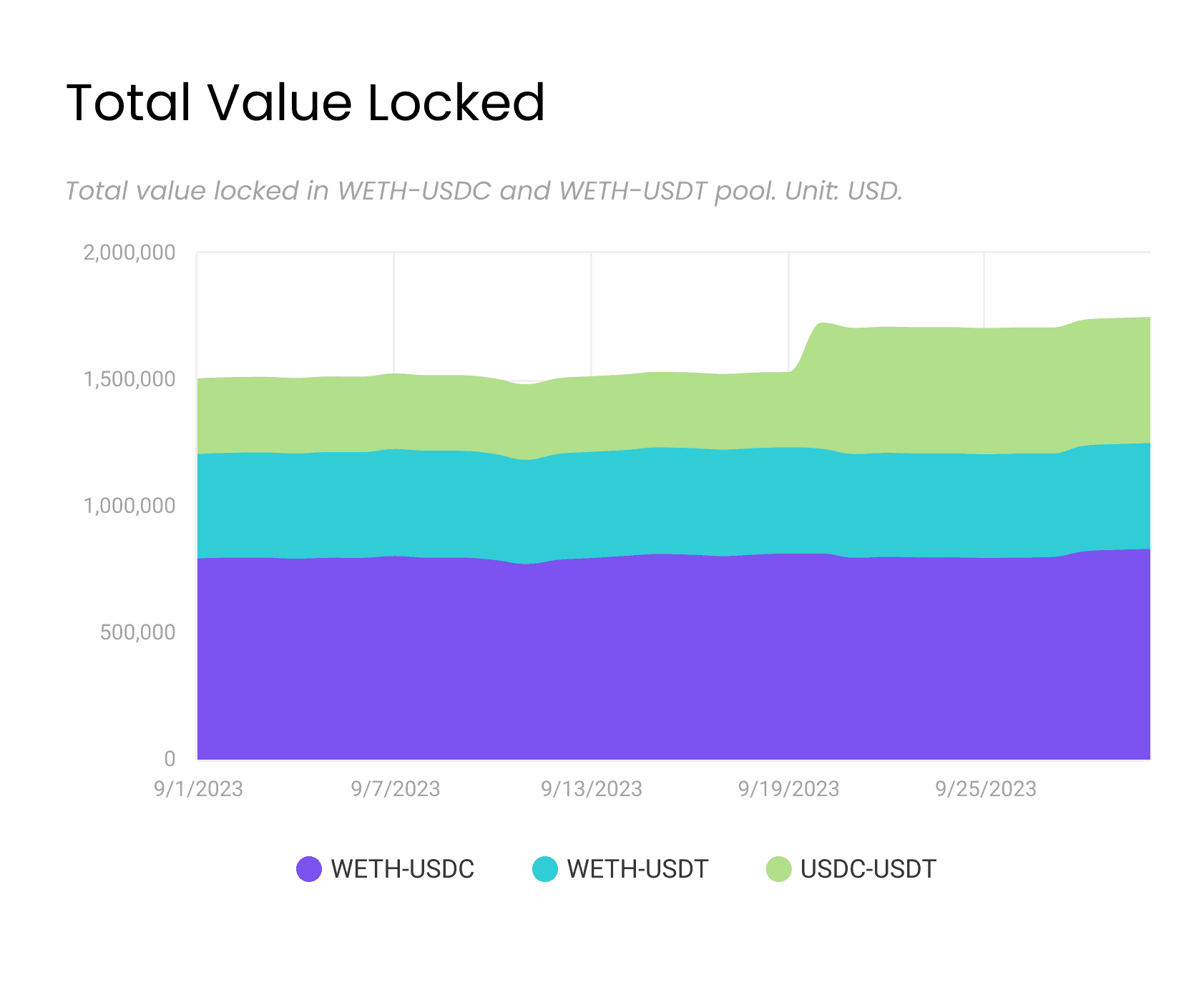

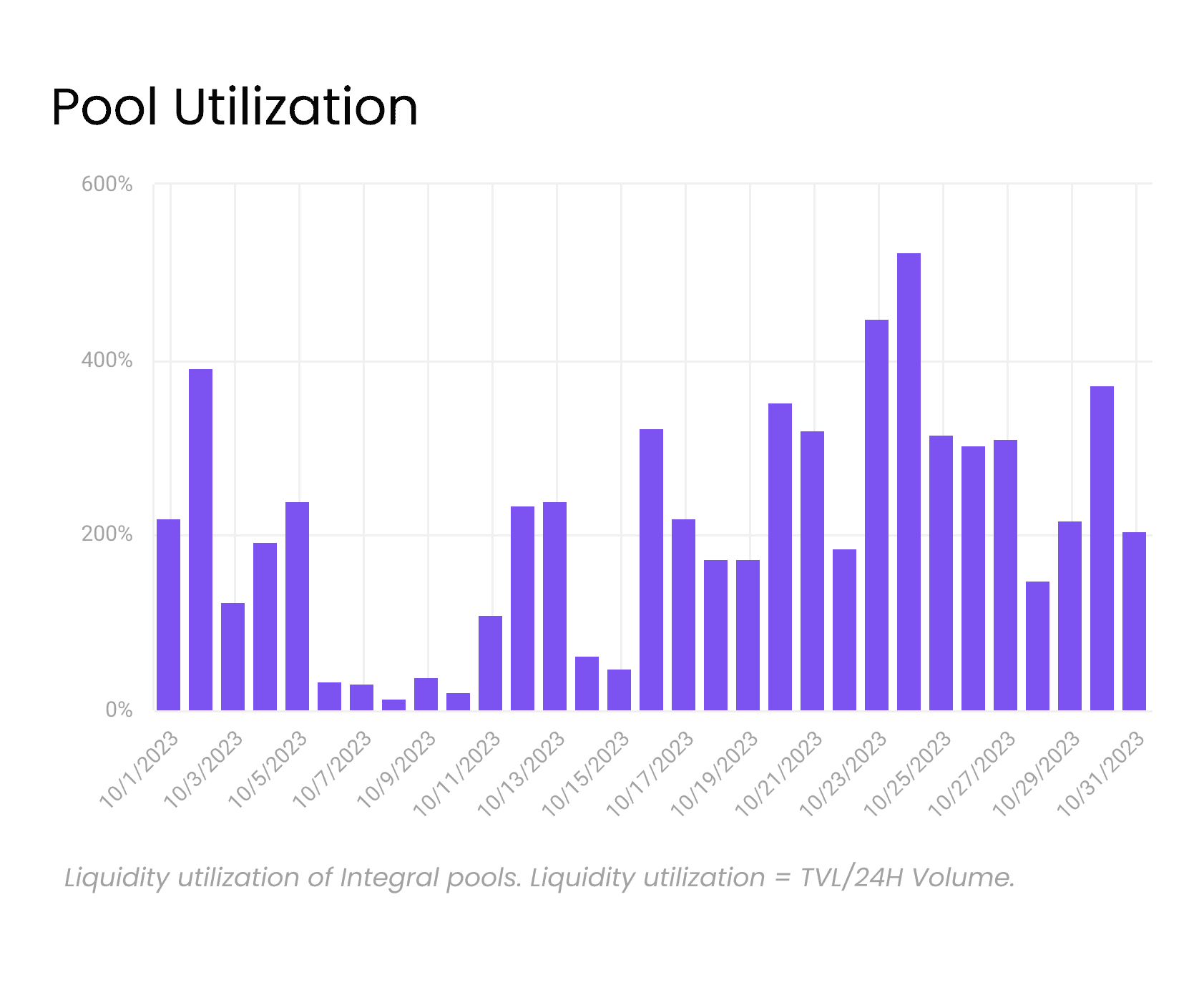

Monthly Analytics

October has truly been a month of milestones, learning, and community engagement at Integral. We’re always grateful for your support and enthusiasm. As we move forward, expect more updates, improvements, and opportunities to engage with us.