How to Make L2 a Better Home for Whale Trading

Jul 27, 2022

TL;DR: Whales still haven’t migrated in numbers to L2s. Integral SIZE is going to help this on Arbitrum.

It has been almost one year since the Arbitrum network launched. The Layer 2 takes advantage of optimistic rollups to provide a fast and cheap EVM network for users. Layer 2s are a big part of Ethereum's scaling roadmap.

One problem of scaling L2s like Arbitrum is liquidity. Without sufficient liquidity, it is difficult for whales to ape in and harder for projects to scale.

[Read: How to attract liquidity to your DeFi project]

In the absence of liquidity, more capital efficient DEXs can serve as a way to facilitate large trades by whales.

At Integral, we are always interested in the user experience of trading, especially for users submitting large trades. We looked at Arbitrum's largest DEXs, Uniswap and Sushiswap, to see how traders fared as the L2 launched and grew. In part 1 of this post we will look at some general trends in trading on the two exchanges, and in part two we will explore trading slippage in more depth.

The Data

To start, we pulled transaction data from Uniswap and Sushiswap on Arbitrum to get every trade that had passed through each venue. It was a lot of data. Arbitrum transaction data also just got added to Dune, so go wild!

Trading Basics

Overall there were a huge number of trades. As is typical, many of these are going to be from arbitrage and other types of bots. They are even more active on L2s like Arbitrum because of the cheap transaction fees.

There is also an interesting situation because Uniswap v2 is not deployed on Arbitrum. Instead, Sushiswap is the dominant “xy = k” DEX on the L2. However there is still Uniswap v3, and even though it has less TVL, it offers the benefits of concentrated liquidity. We will compare the volume and trade size to see how the two DEXs compare.

Sushiswap Trading Sagas

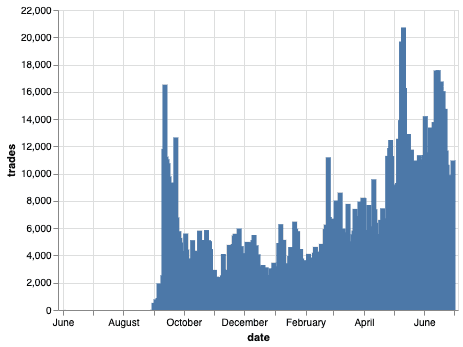

There were 1,872,498 individual trade transactions on Sushiswap pairs.

We took a look at swaps between WETH and USDC, one of the most traded pairs on the exchange. There were over 200,000 trade transactions going each way for a grand total of over 415,000 transactions in total.

WETH to USDC trade numbers came in at a bit higher so we will look at these first.

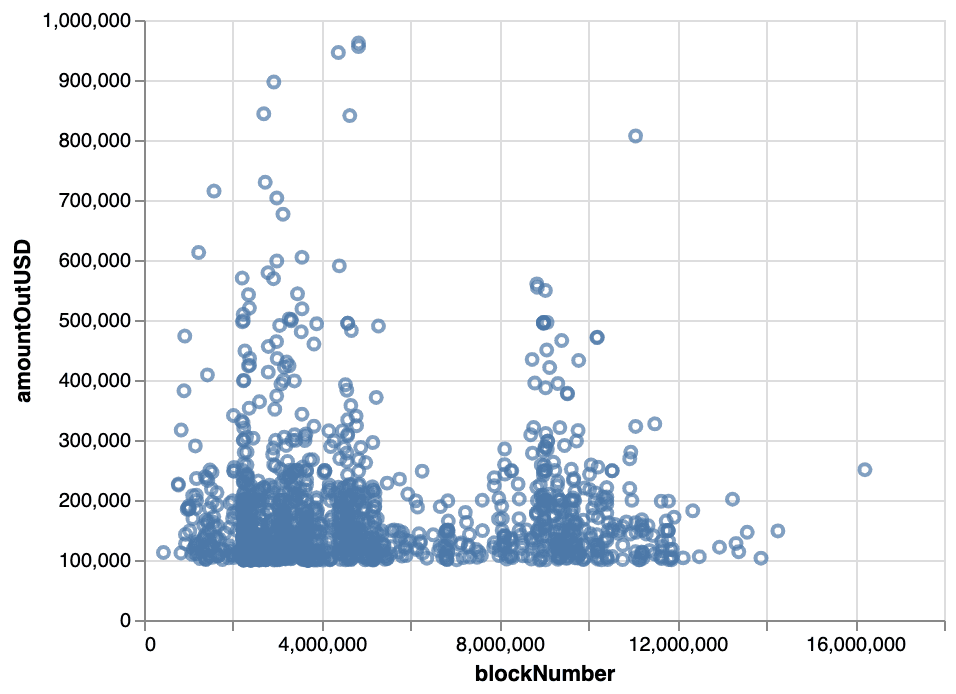

As is typical, there were many more smaller trades than larger ones. But the data shows just how sparse whale trades are on L2s. There were only 4 trades with more than $1m in token out value. 3 from WETH to USDC and 1 from USDC to WETH. We can expect this because constant market maker pools without liquidity cannot facilitate large trades without high slippage.

Going down in size, there was still a lack of large trades on Sushi. Just over 3,000 trades with size over $100k and less than 100k trades for more than $10k in value.

There were 32 trades with over $1m in token output value and the chain data reveals some epic stories. Take for example this trader that doubled their ETH in 10 days by trading $MAGIC.

Uniswap Trades

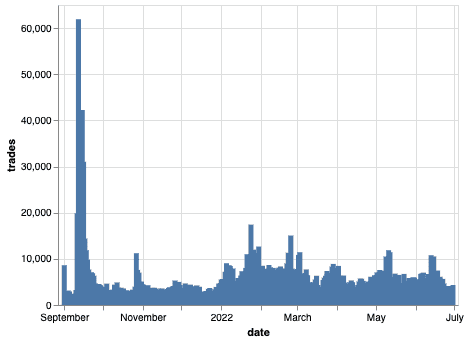

We looked at all trades on Uniswap Arbitrum. There were slightly fewer trades on Uniswap with 1,863,601 unique transactions. However, compared to Sushi where trade counts have roughly stayed the same, Uniswap shows a heavy increase since launch on Arbitrum.

Concentrated Liquidity vs Constant Market Making

As discussed above, we can expect that as a constant-product AMM, whales can only make use of Sushi in unique situations. Uniswap, with its concentrated liquidity could fare better.

The largest protocols on Arbitrum have been unique implementations that don't exist anywhere else in chainspace. GMX, Dopex and Magic have all carved out a niche on the Arbitrum network.

However, large trades are still not the norm on Layer 2, even when there are plenty of whales that want to explore these new protocols.

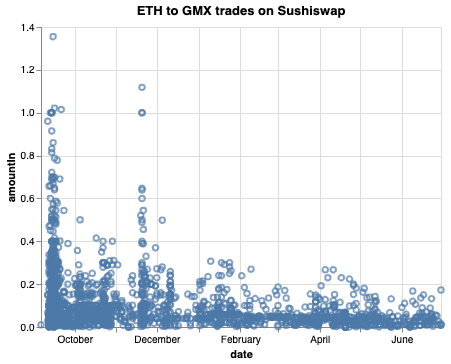

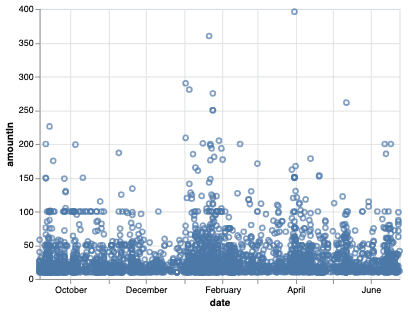

Here are GMX trades on Sushiswap from ETH, showing that most trades aren't being done in large size.

Meanwhile on Uniswap, there were less than 200 trades from ETH to GMX with a value of more than 100 ETH. The largest being a later trade for 396 ETH.

ETH to GMX Trades on Uniswap

Even for a heavily traded L2 token, most trades are well under 50 ETH.

Why Arbitrum Needs Integral SIZE

To recap, although there is a large volume of trades on Arbitrum, there are still not many large trades. Even with the addition of Uniswap v3's concentrated liquidity, Layer-2 solutions haven't attracted the same whales that are on Mainnet.

With cheaper transaction cost and faster confirmation time, Layer-2 solutions like Arbitrum will be the next-gen human-blockchain interface. Right now, it’s not versatile enough to handle all sorts of transactions. DEXs with additional features for whale traders like Integral SIZE will continue to attract large capital to the Arbitrum ecosystem.

Integral SIZE has multiple firsts for Arbitrum:

1st DEX to offer TWAP execution and 0 price impact trading for any order size

1st DEX to offer MEV protection

1st DEX to offer mean-zero impermanent loss for liquidity providers

On Mainnet Integral SIZE has already handled ~20mil volume in the 3 months since launch. The average order size is 3x bigger than leading aggregators with traders having an average wallet size of $849k. We are excited to see what trading activity will be unlocked now that Integral SIZE is coming to Arbitrum.

If you would like to discuss the above topic more in depth or want to suggest a new topic, please connect with our team and community in Discord.