ETH-USDT: New Token Pool on Integral

Mar 24, 2023

We are excited to announce the upcoming launch of the ETH-USDT pool on Integral SIZE. Rewards for liquidity providers (LPs) will start from 00:00 UTC +0 on March 27th.

Why it matters: Integral pool provides traditional liquidity-provision risk/return profile similar to that of Uniswap and Sushiswap, but better.

Zoom in: As a liquidity provider to Integral pools, you can take advantage of the following benefits:

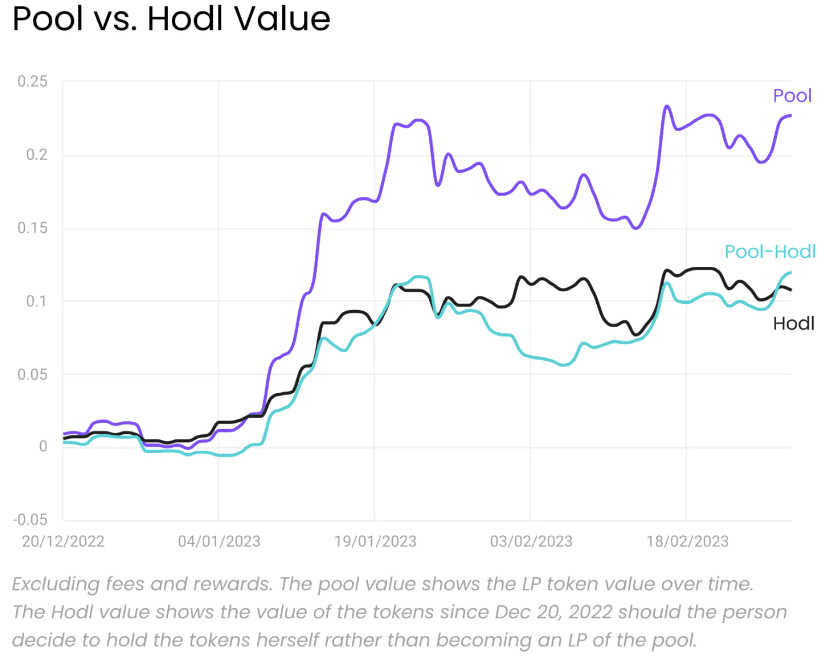

Impermanent Loss Protection: Although there is a possibility of impermanent losses, historically, Integral pools have not experienced impermanent losses on average, thanks to our innovative pool design.

Liquidity Mining Program: LPs of the ETH-USDT pool will receive attractive $ITGR rewards from the liquidity mining program (more details to follow).

Single-sided liquidity available: LPs can supply ETH and USDT as a pair or provide single-sided liquidity.

Updated Farming Rewards Plan

In light of the new ETH-USDT pool launch, we are updating our farming rewards plan and announcing the cessation of incentives for the Arbitrum pool on the following Monday. We have high hopes for Arbitrum, and will restart incentivizing the pool once there’s an Arbitrum version of our relayer.

Changes in Ethereum mainnet and Arbitrum base emissions

Ethereum mainnet

USDT-ETH mainnet base emission starting at 25k ITGR per week.

USDC-WETH mainnet base emission at 25k ITGR per week (previously 50k).

Arbitrum

USDC-WETH base emission on SIZE cut to zero.

How to calculate your token rewards and maximize them

Base Reward emission are calculated and accredited in real-time. LPs will be able to view their latest $ITGR balance on the Integral site next to the wallet address.

Each LP will be given a multiplier based on a snapshot taken at the start of each week at 00:00 UTC Sunday. The LP bonus multiplier depends on the amount and duration of ITGR staked. If an LP is qualified for different multipliers, the maximum multiplier will be used in the bonus multiplier calculation. Rewards contributed by the multiplier will be calculated and accredited at the end of each week.

To get a multiplier of 2 (2x rewards), you need to have ≥ 10,000 ITGR staked for 3 years.

To get a multiplier of 1.5 (1.5x rewards), you need to have ≥ 5,000 ITGR staked for 3 years.

To get a multiplier of 1.2 (1.2x rewards), you need to have ≥ 5,000 ITGR staked for 6 months.

With the launch of the ETH-USDT pool on Integral, there is a new opportunity for cryptocurrency traders and liquidity providers to benefit from our advanced pool design and attractive rewards program. Learn more about Integral and start trading with us today at: https://integral.link/