Who’s Gonna Protect You from MEV after the Merge?

Sep 6, 2022

Everyone is on edge waiting for The Merge - Coming soon to an Ethereum blockchain near you - sometime in the next 2 weeks with estimates around September 15th.

So, while we sit around and wait for (literally) nothing to happen, what better way to pass the time than to dive in to the latest Ethereum drama? Let's go!

In the aftermath of the US sanctioning immutable code and the Netherlands putting an open source developer in jail, we thought things couldn't get more spicy. We were wrong.

The latest tea comes from a tried and true source: MEV. Maximal Extractable Value, or MEV, has provided great conversation fodder, from sandwich attacks to rouge NFT sellers.

So, while we sit around and wait for (literally) nothing to happen, what better way to pass the time than to dive in to the latest Ethereum drama? Let's go!

In the aftermath of the US sanctioning immutable code and the Netherlands putting an open source developer in jail, we thought things couldn't get more spicy. We were wrong.

The latest tea comes from a tried and true source: MEV. Maximal Extractable Value, or MEV, has provided great conversation fodder, from sandwich attacks to rouge NFT sellers.

This time, it's centered around MEV and the Merge, fighting for the future of extractable value in the coming age of proof of stake.

In Proof of Stake, it's stakers, not miners who get the chance to extract MEV.

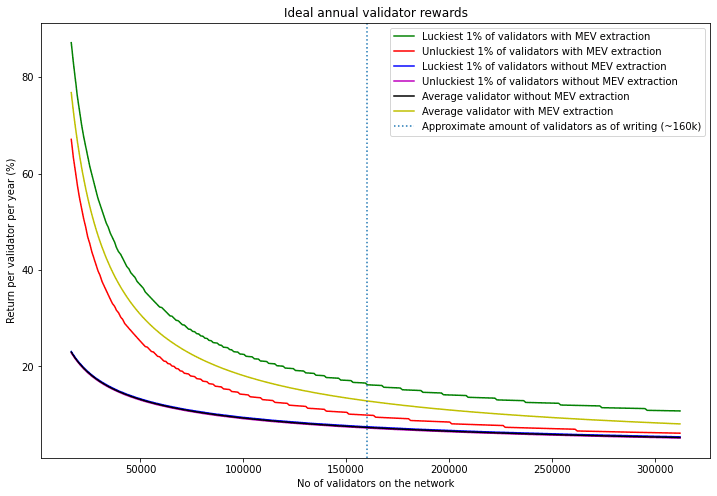

While some stakers may not bother, studies show it can be 2-3 times more profitable to stake while conducting MEV.

This means any staker not doing so is leaving money on the table, and potentially diluting their stake in the network.

To make it easy for stakers to reap the rewards of MEV, the Flashbots team released software called mev-boost. Just like the current Flashbots system, mev-boost feeds MEV transactions to block producers, but with a few key differences.

Most importantly, mev-boost only feeds in full blocks. Flashbots has said this is to prevent front-running and/or block producers from stealing profits from searchers. Searchers are looking for and compiling profitable MEV opportunities in to blocks and we don’t want block producers reading the block contents. They could recreate and submit the blocks themselves, but not give any cut for the searcher. So, the obfuscation has a fair reason, but it also comes with implications.

For one, the mev-boost has centralization risk. It works as a bit of a market for blocks. Searchers put together transactions, and submit full blocks to an API relay run by Flashbots. The relay then does some checks on the blocks and passes it on to a block producer. The block producer (post-merge this will be stakers) pulls full blocks and adds them to the chain, sight unseen. A relay that is very likely OFAC compliant and excluding (or censoring depending on your view) transactions. This is the only relay set to run post merge.

https://x.com/pappas9999/status/1562075136840577025

This raises existential questions for the Ethereum network. For instance, why was the network basically handing over block production to a centralized entity that may or may not be excluding transactions because of political risk?

https://x.com/dimsomedim/status/1560174040899530755

At least those were the questions raised on a recent All Devs Call.

A diplomatic dev leader sharing the latest tea:

https://x.com/TimBeiko/status/1560345029511589888

So, what should be done about this?

Some proposals go as far as suggesting mev-boost removal from the mix until the network has spent some time on proof of stake. We even saw someone suggest that the merge be postponed.

That may be a bit too much, but others are thinking of solutions.

To their credit, the Flashbots team responded by open sourcing mev-boost.

https://x.com/JasonYanowitz/status/1559918756402429963

That may not be enough. Running relayers and searching for MEV opportunities is intense work. Telling stakers, who are already babysitting their clients, to run even more complicated software is a large ask.

Regardless, we expect stakers to take advantage of MEV opportunities, with or without the help of Flashbots. The rewards earned stand to be quite lucrative. Plus, MEV only adds to the yield from staking your ETH.

A number of other relayers are springing up as a response, and it remains to be seen how the Ethereum community will deal with MEV in a post-merge world. From our end at Integral, we're definitely keeping a close eye on developments.

In the meantime, if you want to trade or LP without exposure to MEV, Integral SIZE provides an MEV-protected trading venue. With a 30-minute TWAP and no atomic swaps go through, Integral SIZE pools deliver MEV protection for traders and net-zero impermanent loss for LPs.

Try it today and Trade with SIZE!