How Are Whales Moving Ethereum Price before the Merge?

Sep 12, 2022

As avid whale watchers here at Integral, we know one of the most anticipated events by whales and degens alike will be The Merge, set to happen this week.

With this in mind, we're going to take a look at how whales are positioning on chain in preparation for the merge.

Are whales staking?

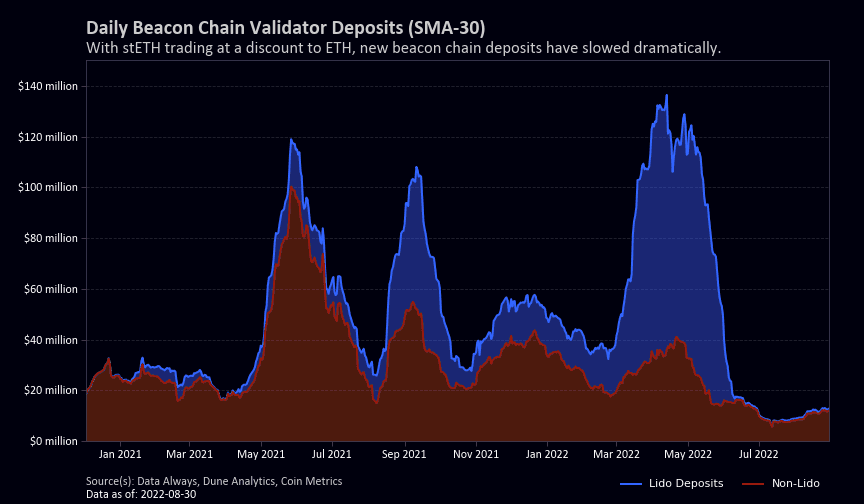

While forecasts suggest The Merge could push staking yields higher, deposits into the beacon contract have declined into the event.

This could be due to the market taking a more risk-adverse stance to the technical risk of the merge.

Lido deposits in particular are down big. Since the stETH depeg drama in May, it has been cheaper to buy stETH off of the market than to deposit ETH through the Lido contracts. This has lead to Lido deposits going to nearly zero.

Are whales playing the PoW ETH trade?

One play has been trying to maximize on-chain Ether holdings in order to take advantage of a possible fork that continues the Ethereum proof of work consensus.

By depositing collateral in lending protocols and borrowing ETH, traders can pay the ETH borrow rate until the merge happens and then repay their ETH borrowed. On the proof of work chain, any collateral other than ETH will be worthless, so on that chain the trader could walk away with their loan and leave the protocol with bad debt.

Variations of this have caused the Aave ETH borrow rate to spike over 40%.

https://x.com/smyyguy/status/1567211603904315392

In reaction to these whale waves, DAOs are passing various proposals to protect user funds and stabilize markets in the lead up to the merge.

While we are more interested in on-chain data, the various off-chain markets are also reflecting increased volatility for ETH.

https://x.com/laevitas1/status/1567809732663992321

What about other whale trades for the merge?

There are some other options on chain for traders looking to play the success (or failure) of the merge; a popular idea emerging in the decentralized lending market, Euler Finance. Euler is one of the only markets on chain where you can borrow stETH. This means that whales AND degens can take two-sided bets for or against the success of staked ETH. While it is a bit expensive to borrow staked ETH, some whales are playing the merge by shorting stETH instead of doing a leveraged long.

This means the additional supply rate for stETH has been quite attractive for Euler depositors, giving them and extra 1-2% per year for their deposits on top of the stETH base staking yield.

What about ETH withdrawals?

Withdrawals for staked ETH won't be available until the Shanghai hard fork, which doesn't have a hard date set yet. Withdrawals will also be gated and could have a long queue meaning ETH staked in the beacon chain might not be hitting the open market for up to a year.

It remains to be seen the amount of ETH that will make its way out of staking once it is available. For now, stakers will be content with hopes of higher yields in the post-merge universe. Some projects put staked ETH yield at over 10%.

https://x.com/Cointelegraph/status/1567852826100916229

What should regular users do?

To prepare for the merge, most DeFi users won't need to do much. The chain should switch over from Proof of Work to Proof of Stake mechanisms without any disruption for DeFi protocols. The merge is just a change in the execution layer, not state or consensus layers. This means DeFi on Ethereum should continue as before. If everything goes smoothly, DeFi users won't even notice a difference.

Enjoy The Merge!

If you would like to discuss the above topic more in depth or want to suggest a new topic, please connect with our team and community in Discord.