Integral Relayer Launches on Arbitrum

Sep 7, 2023

We are excited to announce the launch of the Atomic Relayer on Arbitrum. This will bring the efficient and tested system for atomic trades to the Arbitrum Layer 2 network! We have been running the atomic relayer for the past few months on Ethereum mainnet, and with some additional upgrades, the same features are now available on Arbitrum. You can find the deployment of the Atomic Relayer on Arbitrum here.

For Aggregators:

Integral has already integrated with many aggregators on Ethereum Mainnet. If you’re interested in adding Integral to your aggregator, please reach out on Twitter or Discord.

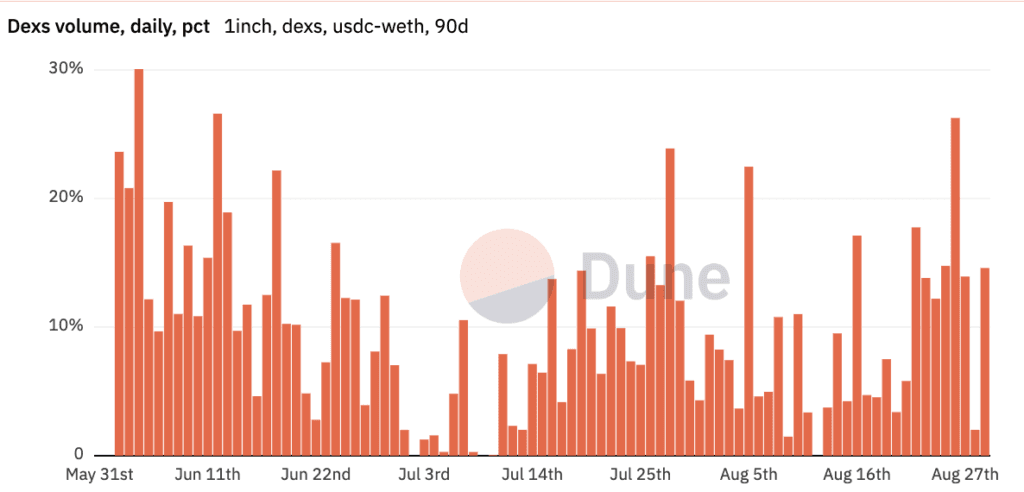

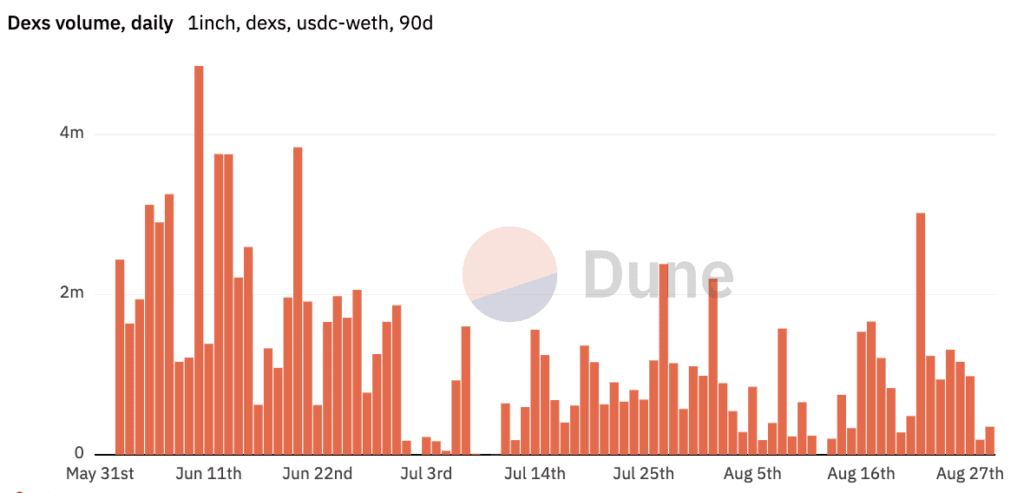

Volume Tested Design: In the past few months, Integral's volume and utilization has been nothing short of impressive. The atomic relayer has performed beyond our expectations, with Integral regularly processing over 10% of the ETH-USDC volume on top-tier aggregators. This has kept Integral as one of the top DEXs in capital utilization and volume.

Ease of Integration: One of our core tenets is ensuring our partners experience seamless integrations. We've streamlined the process, ensuring aggregators can quickly and effectively onboard with us. Dive deeper into our straightforward integration process here: Aggregator Integration Guide.

Optimized Trading: With the Atomic Relayer in place, aggregators will benefit from the smart contract's capacity to provide immediate atomic liquidity. The Integral relayer bridges the gap, acting as an intermediary between on-chain traders/aggregators and Integral pools, allowing swift trade execution while routing to our pools in the background.

For Traders

Integral’s atomic relayer has already facilitated $100s of millions in swaps, getting traders some of the best on-chain execution with MEV protection and minimal slippage.

Expanding Horizons: We are extending the power of atomic swaps to Arbitrum. Now users on this Layer 2 network can harness the advantages of swift and efficient trade execution from the Integral relayer. This brings lower slippage, MEV-resistance and more features to Arbitrum.

Empowering Traders: With the advent of the Atomic Relayer, traders can now enjoy the benefits of trading in Integral liquidity pools with minimal price impact. And the best part? No need to wait for the 30-minute TWAP delay.

You can go try out the new features today at https://app.integral.link/

Coming soon will be more features including limit orders, more efficient routing between pools and an updated code base for the relayer. Stay tuned for the latest updates on our blog and social channels.