Integral Now Rewards Liquidity Providers with Trading Fees

Nov 28, 2023

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.

We are thrilled to announce the latest upgrade to Integral's liquidity provision system. This enhancement enables liquidity providers (LPs) to directly receive a portion or all trading fees from Integral pools. LPs can receive these fees in the tokens constituting the pool, such as WETH or USDC.e in the WETH-USDC.e LP.

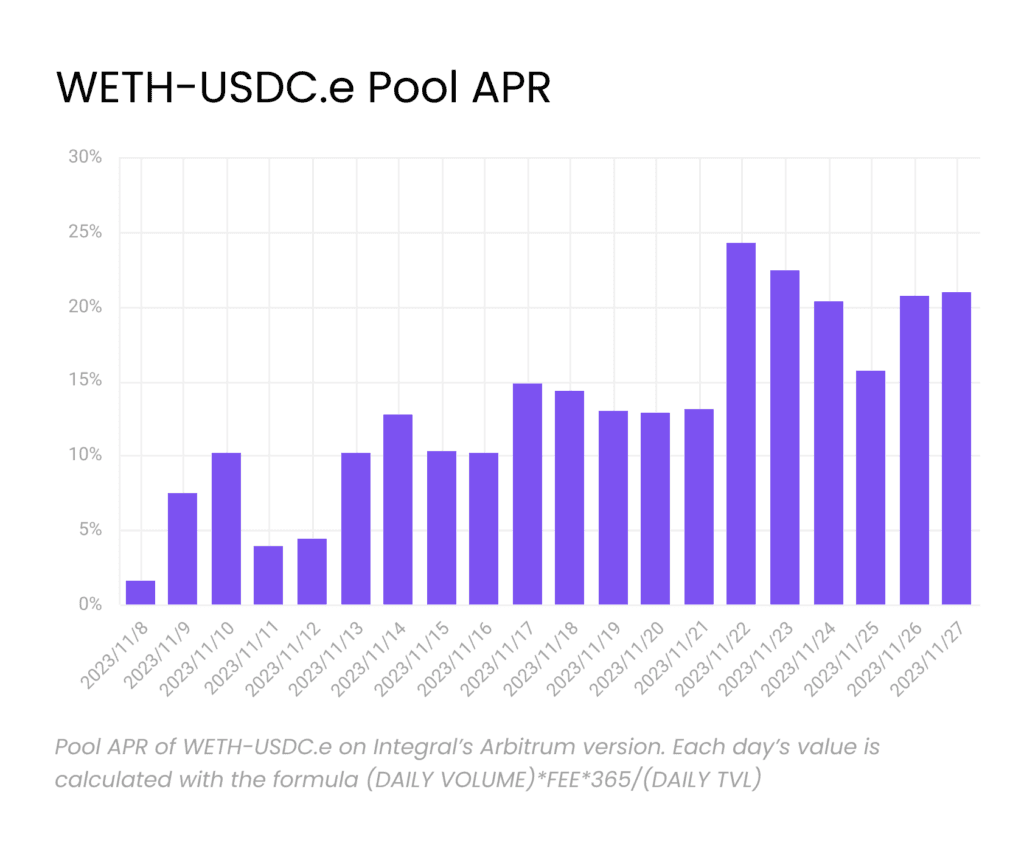

For context, the WETH-USDC.e pool on Arbitrum has recently boasted an average APR of 13.15%, calculated from daily fees over the past two weeks.

This feature debuts on the Arbitrum version of Integral from November 30th, 2023 (Thursday), with a planned deployment to the mainnet in the near future. Experience it at Integral's Arbitrum version.

Tracking Liquidity Returns

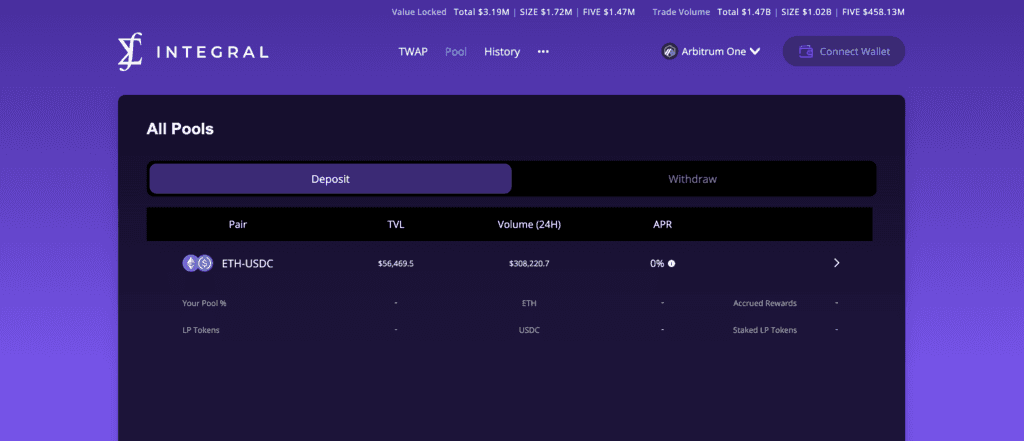

The simplest method to monitor the returns of your liquidity position is by utilizing the LP interface. To access this interface, click on the "Pool" tab within the app.

Please take note of the following:

The APR shown is calculated based on the fees and TVL at the pool level.

You can utilize this figure to estimate the returns of your position manually.

The "Accrued Rewards" displayed on the LP interface only includes the ITGR rewards that you have accumulated before October.

Why choose Integral to provide liquidity

Integral's LP system excels with high capital efficiency and mean-0 Impermanent Loss (IL), setting it apart from other DEXs:

High Capital Efficiency: This metric, the ratio of daily volume to TVL, indicates frequent utilization of LP funds. Integral ranks among the top five DEXs in capital efficiency, leading those without professional or off-chain market makers, with an impressive 337% ratio. This translates to competitive APRs, as evidenced by the WETH-USDC.e pool on Arbitrum, averaging 13.15% APR in the last two weeks.

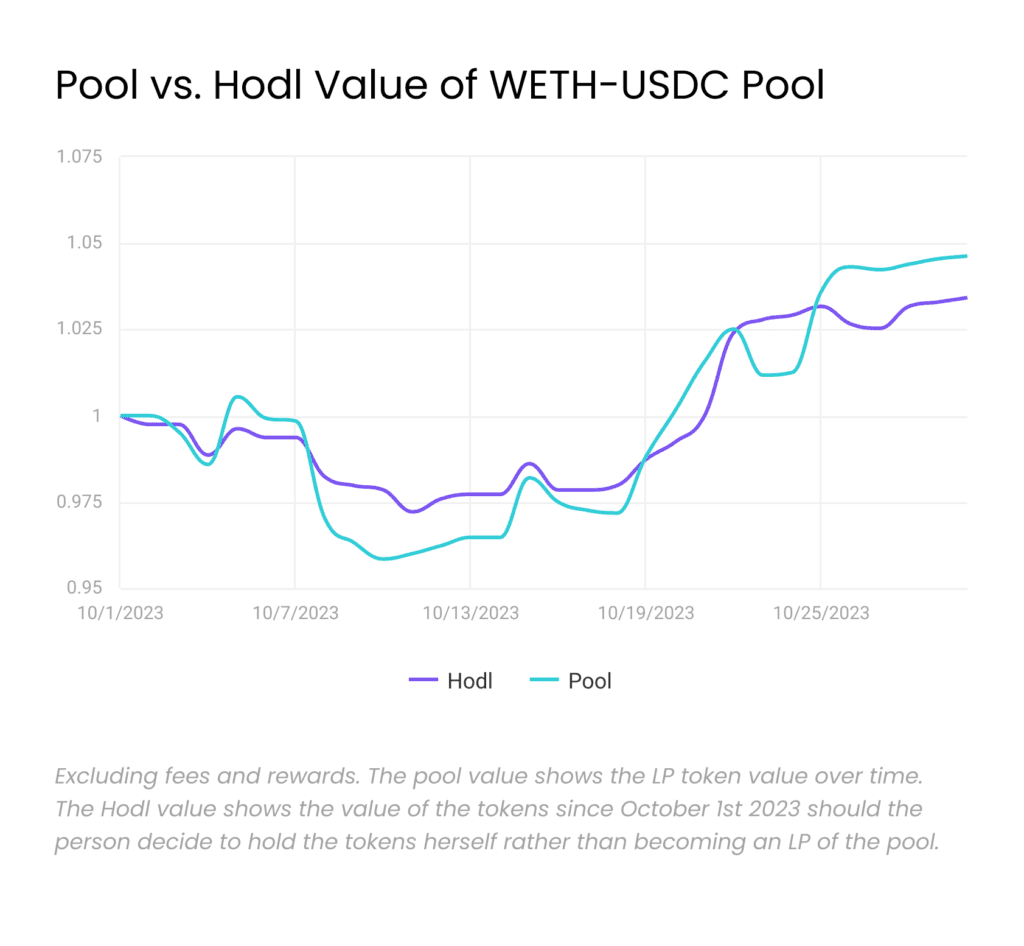

Mean-0 IL: This feature suggests that there are periods when IL is negative, potentially offering more profitability than merely holding assets. Over a long period of time, IL tends towards zero, often making liquidity provision more advantageous than simple asset holding. The graph below illustrates that within the specified timeframe, the liquidity position on Integral (Pool) has appreciated more than holding the same starting amount of tokens (Hodl).

Integral LP system stands out primarily because its liquidity pools are extensively used by aggregators like 1inch and Odos, due to our competitive pricing. This results in a daily volume of around $5-6 million, with a record high of $10 million. This high usage generates substantial fees for liquidity providers. With an upcoming upgrade and enhanced gas optimization, we anticipate becoming more competitive for major token-pair swaps. We encourage aggregators and solvers seeking competitive on-chain quotes to contact us.

Concluding Thoughts

Integral's core is bolstered by our liquidity providers and order flows. This LP system upgrade marks a significant step towards enhancing our sustainability in liquidity provision, elevating our competitiveness in token-pair swaps.

We extend our heartfelt gratitude to our community for your unwavering support. 2023 has been a landmark year for Integral, and we're proud to wrap it up with this significant update.

To experience our new system, visit Integral on Arbitrum this Thursday. Fee distribution commences at 00:00 UTC+0.