Integral Now Rewards Liquidity Providers with Trading Fees on Ethereum Mainnet

Dec 12, 2023

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.

Riding on the momentum of our successful launch of the new liquidity provision system on Arbitrum, we're excited to roll out this system on the Ethereum mainnet. This development allows liquidity providers (LPs) to directly earn a share or the entirety of the trading fees from Integral pools. LPs will receive these fees in the tokens that make up the pool, like WETH or USDT in the case of the WETH-USDT LP.

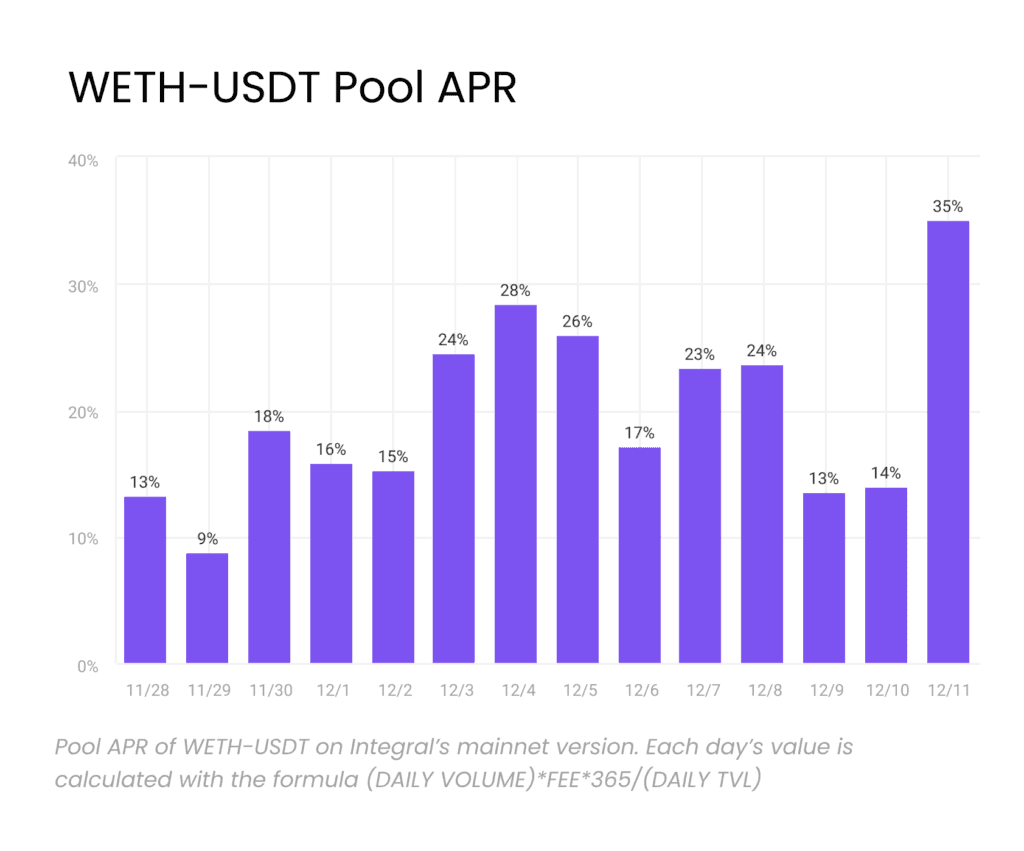

For example, the WETH-USDT pool has recently showcased a notable average APR of 22%, a figure derived from daily fees over the previous week.

This feature will be operational on Integral's Ethereum mainnet starting December 14th, 2023 (Thursday), at 0000 UTC+0. You can explore it here.

Monitoring Your Liquidity Earnings

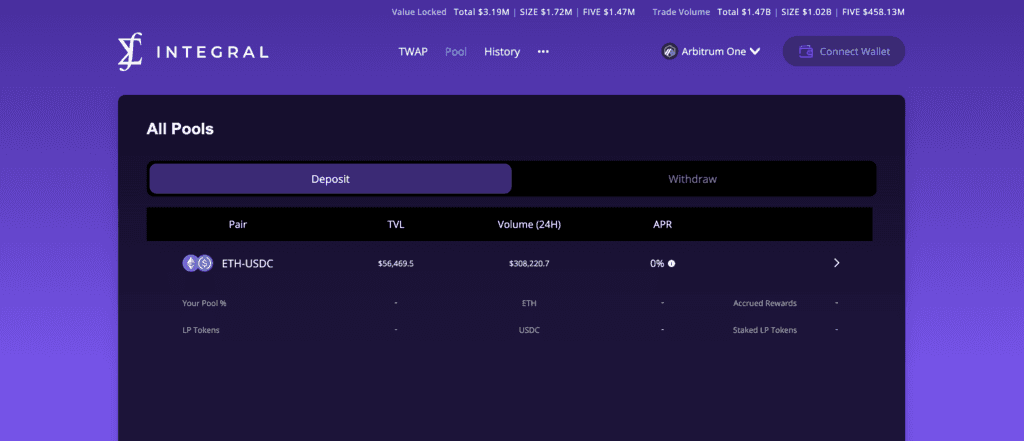

To keep tabs on your liquidity position's performance, simply use the LP interface. You can find this by clicking the "Pool" tab in the app. Here are some points to remember:

The displayed APR is an average over 7 days, based on the fees and TVL at the pool level. This helps you manually estimate your position's returns.

The "Accrued Rewards" section in the LP interface shows only the ITGR rewards accumulated until October.

Why Integral is the Go-To for Liquidity Provision

Integral's LP system stands out for its high capital efficiency and its unique mean-0 Impermanent Loss (IL), distinguishing it from other DEXs:

High Capital Efficiency: This measure, the ratio of daily volume to TVL, signifies the frequent use of LP funds. Integral is a top contender in this aspect, especially among DEXs without professional or off-chain market makers, boasting a remarkable 600% ratio. This high efficiency is linked to competitive APRs, as seen in the WETH-USDC pool's 22% APR average in the last week.

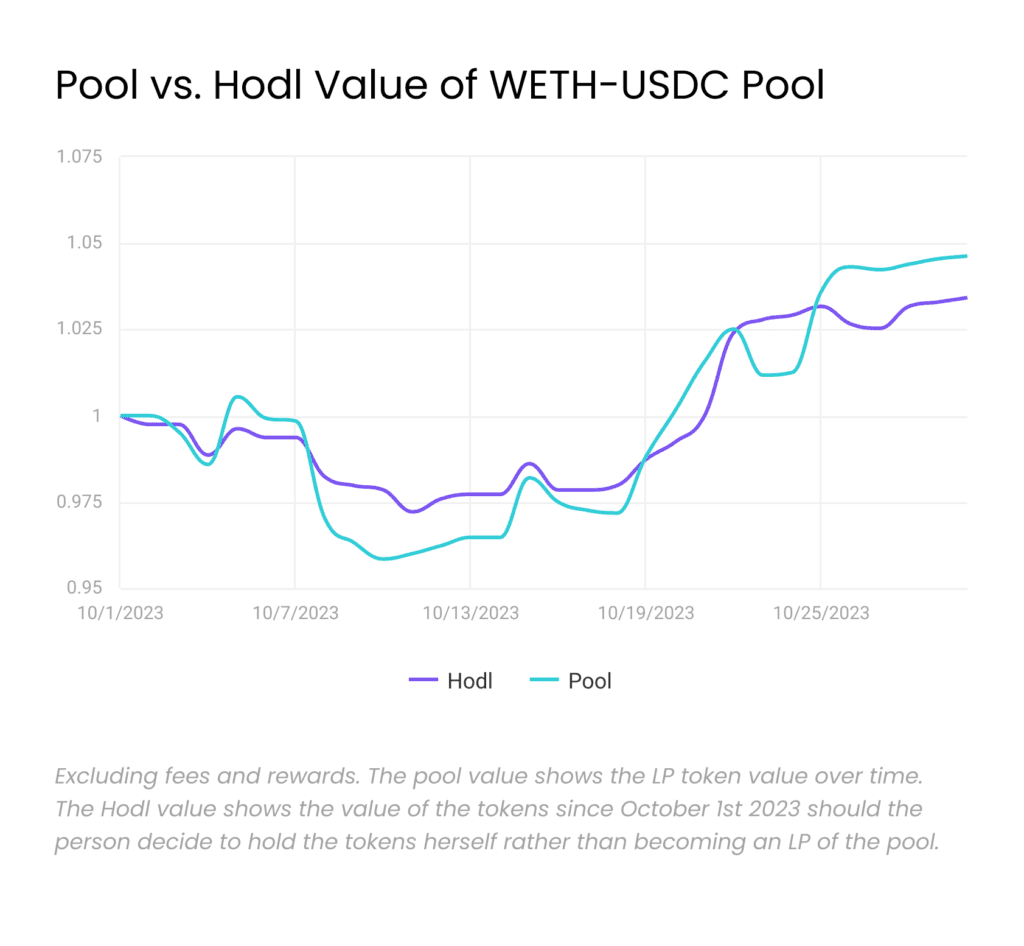

Mean-0 IL: This characteristic means that IL can sometimes be negative, offering potentially higher profits than simply holding assets. Over time, IL generally balances out to zero, often making liquidity provision more beneficial than just holding assets. The following graph demonstrates that, over a specific period, having a liquidity position in Integral (Pool) has been more profitable than just holding the same amount of tokens (Hodl).

Integral LP system stands out primarily because its liquidity pools are extensively used by aggregators like 1inch, Odos and Unidex, due to our competitive pricing. This results in a daily volume of around $5-6 million, with a record high of $10 million. This high usage generates substantial fees for liquidity providers. With an upcoming upgrade and enhanced gas optimization, we anticipate becoming more competitive for major token-pair swaps. We encourage aggregators and solvers seeking competitive on-chain quotes to contact us.

https://twitter.com/UniPreach/status/1733777713885061292?s=20

Final Thoughts

Our liquidity providers and order flows are the backbone of Integral. This upgrade to our LP system is a vital move in advancing our liquidity provision sustainability and competitiveness in token-pair swaps.

We're immensely thankful to our community for your steadfast support. 2023 has been a milestone year for Integral, and we're proud to conclude it with this important update.

To try out our new system, visit Integral on Ethereum mainnet this Thursday. Fee distribution starts at 00:00 UTC+0.