Integral Insights: Oct'24

Nov 4, 2024

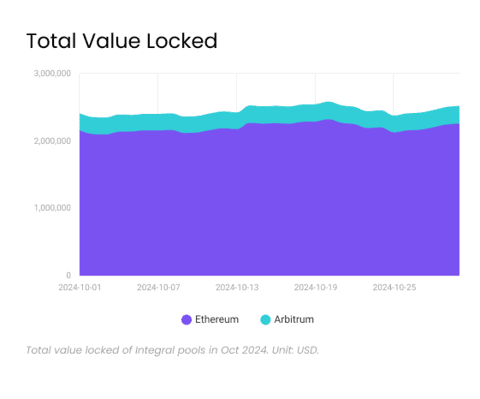

As October draws to a close, we're pleased to share another month of stable growth and impressive performance across both Ethereum and Arbitrum networks. Our passive concentrated liquidity model continues to demonstrate its effectiveness through high utilization rates and attractive yields.

Market Position & Volume Analysis

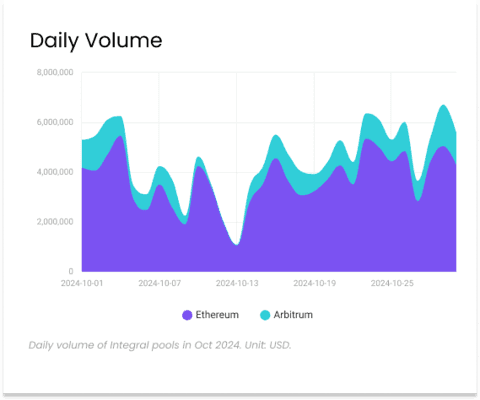

Integral maintains its strong position in the DEX landscape, ranking #13 on Ethereum mainnet and #18 on Arbitrum based on trailing 7-day volume for the month of October. The combined daily trading volume across both networks has shown resilience, averaging around 5.5mm USD daily in the latter part of October - an improvement from the previous 5mm daily average, driven by increased market volatility.

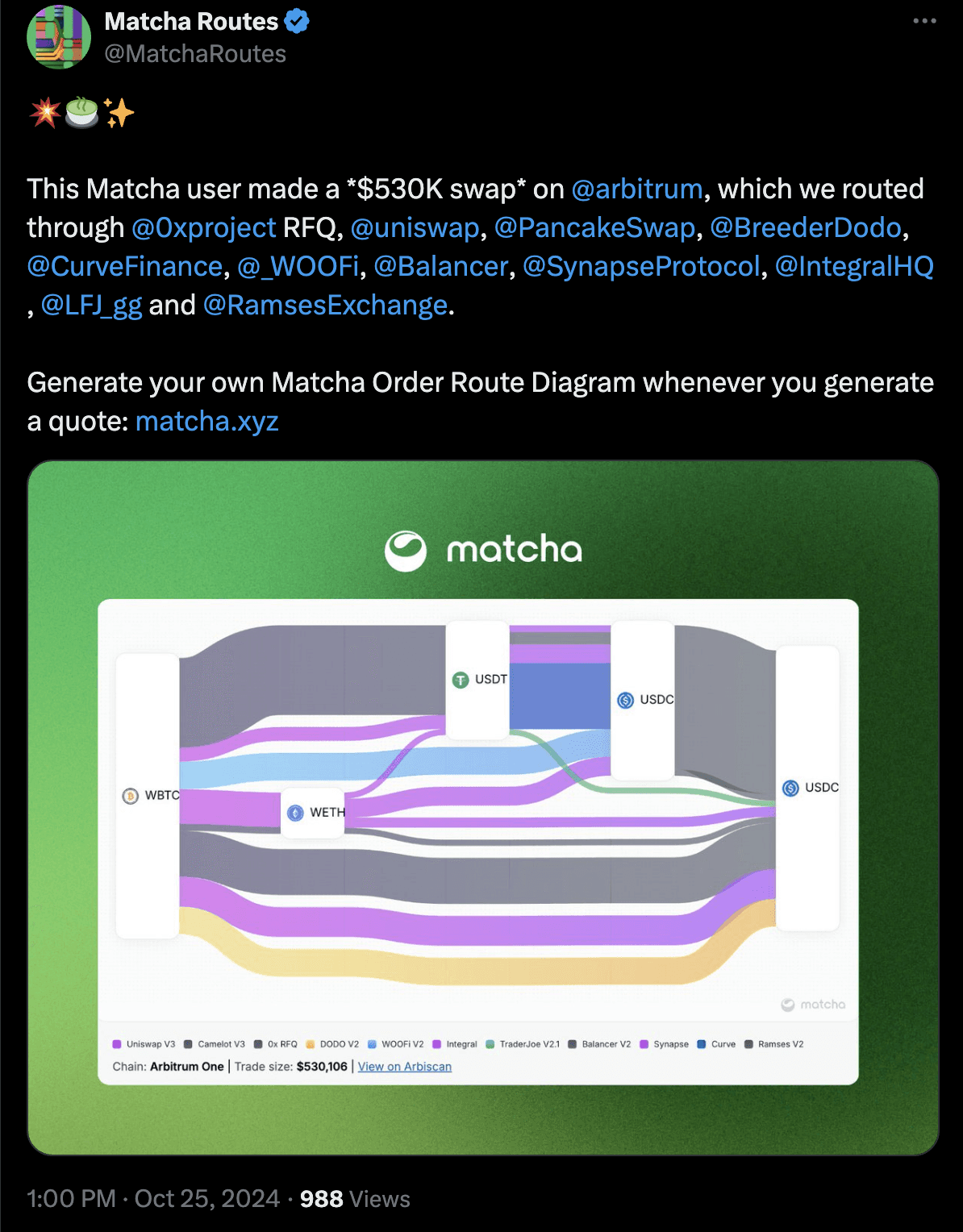

Our liquidity pools continue to play a crucial role in facilitating large trades through major aggregators. This recent $530K swap on Arbitrum, routed through Matcha (0x), showcases how Integral's liquidity works seamlessly alongside traditional DEXs like Uniswap and PancakeSwap to provide optimal execution for traders. The visualization highlights the complementary nature of different liquidity sources across DeFi.

Protocol Metrics

Looking at our October metrics, several pools demonstrated exceptional performance:

Ethereum Mainnet

WETH-USDT: $51.65M volume with 13,258% utilization

WETH-WBTC: $20.81M volume with 6,008% utilization

WETH-WSTETH: $5.53M volume with 2,514% utilization

USDC-USDT: $2.17M volume with 793% utilization

Arbitrum

WETH-USDC: $14.71M volume with 14,065% utilization

WETH-USDC.e: $6.58M volume with 9,732% utilization

WETH-WSTETH: $1.84M volume with 7,180% utilization

WETH-USDT: $1.39M volume with 2,928% utilization

WETH-ARB: $848K volume with 10,730% utilization

Yield Performance

Our Arbitrum pools continue to deliver impressive yields without any additional incentives:

WETH-USDC: ~45% APR

WETH-USDC.e: >30% APR

These organic yields highlight the efficiency of our passive concentrated liquidity model and demonstrate strong trading demand for our pools.

Integration Ecosystem

We maintain a robust network of integrations with leading DeFi platforms:

DEX Aggregators: 1inch, Odos, 0x, OKX DEX, KyberSwap

Cowswap Solvers: Barter, OTEX, Copium Capital

Additional Partners: Unidex, BitKeep, OpenOcean

Looking Ahead

As we move into the final months of 2024, our focus remains on:

Optimizing our integrations to maximize volume contribution

Maintaining our competitive position in both Ethereum and Arbitrum ecosystems

Continuing to provide attractive yields through our capital-efficient passive concentrated liquidity model

Stay tuned for more updates and follow us on Twitter (@IntegralHQ) for the latest news and announcements.