Integral Insights: November ‘24

Dec 6, 2024

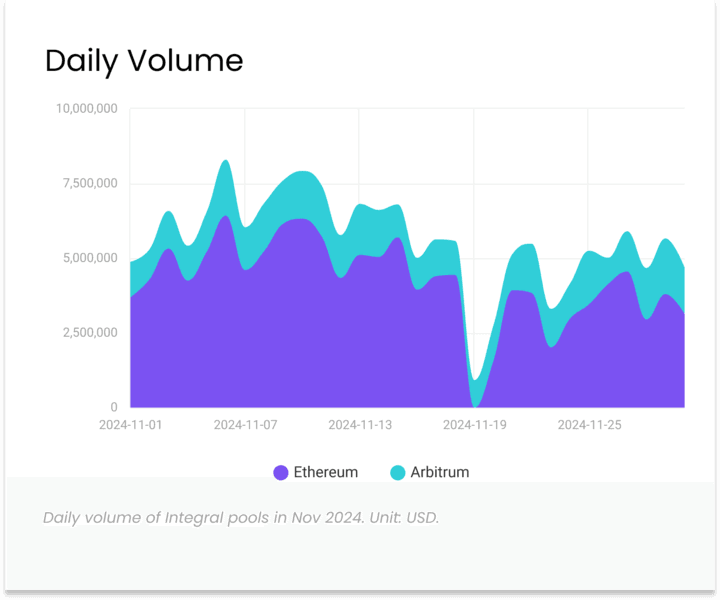

As we conclude November 2024, we're excited to share another month of impressive performance and steady growth across both Ethereum and Arbitrum networks. Our passive concentrated liquidity model continues to demonstrate its effectiveness through exceptional capital utilization rates and consistent trading volumes.

Trading Volume & TVL Analysis

November has shown robust trading activity across our deployed networks, with total monthly volume exceeding $168 million. The daily trading volume has maintained a healthy average, demonstrating the growing adoption of our protocol. Key volume metrics for November:

Ethereum Mainnet

WETH-USDT pool led with $52.6M in volume and an impressive 11,480% utilization

WETH-USDC followed with $44.3M in volume and 5,353% utilization

WETH-WBTC contributed $24.5M with 5,348% utilization

Arbitrum

WETH-USDC pool achieved $23.8M in volume with 19,631% utilization

WETH-USDC.e recorded $10.0M in volume with 12,348% utilization

WETH-USDT, WETH-ARB, and WETH-wstETH pools collectively added $8.4M in volume

Capital Efficiency Highlights

The protocol's innovative design continues to set new standards for capital efficiency, as evidenced by the remarkable utilization rates across our pools:

WETH-USDC (Arbitrum): 19,631% utilization

WETH-USDC.e (Arbitrum): 12,348% utilization

WETH-USDT (Ethereum): 11,480% utilization

These figures demonstrate how our oracle-based pricing coupled with a trade delay enables high trading volume relative to TVL, maximizing returns for liquidity providers.

Integration Ecosystem

We maintain a robust network of integrations with leading DeFi platforms:

DEX Aggregators: 1inch, Odos, 0x, OKX DEX, KyberSwap

Cowswap Solvers: Barter, OTEX, Copium Capital

Additional Partners: Unidex, BitKeep, OpenOcean

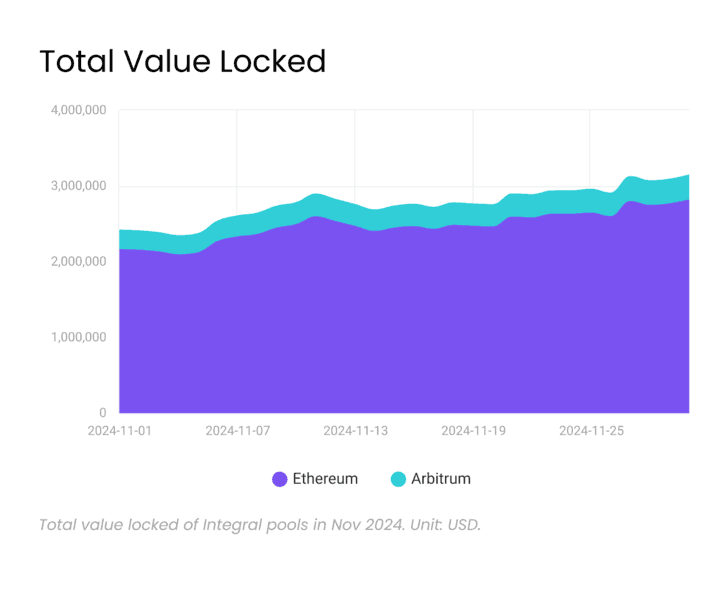

TVL Growth

Total Value Locked has shown steady growth throughout November, with combined TVL across both networks maintaining stability above $2.5M. The distribution between networks demonstrates growing confidence in our Arbitrum deployment while maintaining a strong presence on Ethereum mainnet.

Looking Ahead

As we move toward the end of 2024, our focus remains on:

Optimizing our integrations to maximize volume contribution

Maintaining our competitive position in both Ethereum and Arbitrum ecosystems

Enhancing capital efficiency through continued protocol improvements

Stay tuned for more updates and follow us on Twitter (@IntegralHQ) for the latest news and announcements.