Integral Insights May ‘24

Jun 13, 2024

May has been a remarkable month for Integral, marked by significant achievements and strategic advancements. Here’s a detailed recap of some key highlights:

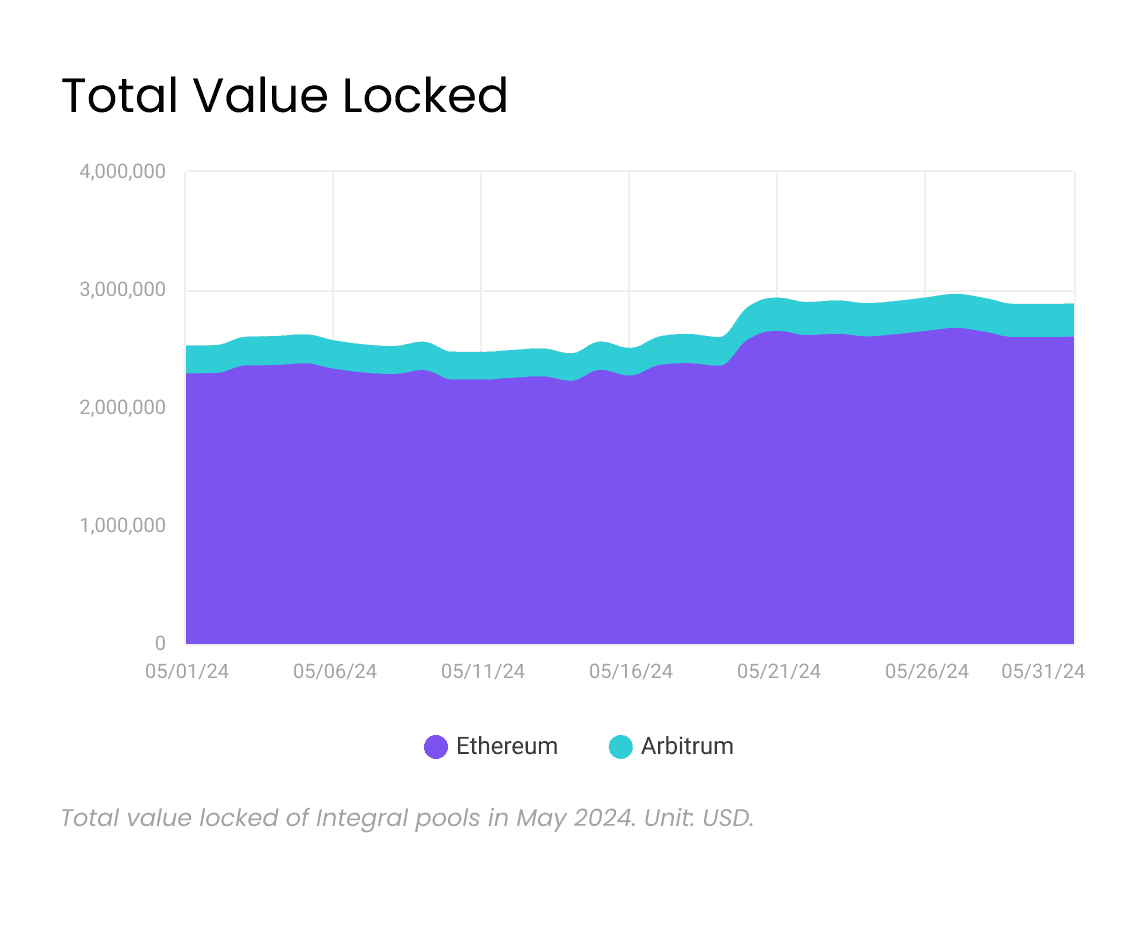

Volume and TVL Metrics

Integral’s volume has been stable in May. According to Defillama, Integral is now #12 on Ethereumand #15 on Arbitrum based on trailing 7d volume.

We continue to make new highs on Arbitrum. Here are some highlights from our Arbitrum pools:

WETH-USDC.e:

Average TVL: $80,780.32

Total Volume: $21,014,817.45

Utilization Rate: 260.15

WETH-USDC:

Average TVL: $78,280.83

Total Volume: $30,928,526.32

Utilization Rate: 395.06

WETH-USDT:

Average TVL: $46,223.31

Total Volume: $2,870,974.29

Utilization Rate: 62.11

WETH-WSTETH:

Average TVL: $30,612.37

Total Volume: $3,210,657.67

Utilization Rate: 104.89

WETH-ARB:

Average TVL: $13,297.69

Total Volume: $2,355,982.67

Utilization Rate: 177.19

The utilization rate is a key metric that indicates how efficiently a pool’s liquidity is being used to facilitate trading. It is calculated by dividing the total trading volume by the average TVL. A higher utilization rate suggests that a pool is generating more trading activity relative to the liquidity locked in it. For example, the WETH-USDC pool has a utilization rate of 395.06%, meaning that for every dollar of liquidity locked in the pool, Integral was able to facilitate $395.06 worth of trading volume. This high utilization rate demonstrates the popularity and efficiency of the WETH-USDC pool on our platform.

Furocombo Integration

We are thrilled to announce our strategic partnership with Furucombo, a leading DeFi platform known for its innovative approach to trading and liquidity management. This collaboration marks a significant milestone for Integral, as we integrate our pool into Furucombo Solver’s sources. Here’s what this means for our users:

Enhanced Stability and Prices: By integrating Integral’s pool, Furucombo aims to improve the stability and prices of its Solver system, ensuring a more reliable trading experience.

Improved Trading Experience: Users can now benefit from Integral’s passive concentrated liquidity, enhancing their trading capabilities.

We are excited about the potential of this partnership and look forward to bringing more value to the DeFi community.

Arbitrum LTIP Grant

In April, we proudly secured an impressive 124 million $ARB votes to win the Arbitrum LTIP (Long-Term Incentive Program) grant. Our proposal for 225,000 $ARB in funding is a testament to our strong community engagement and commitment to the ecosystem. Here are some key updates:

Incentive Distribution: A significant portion of this grant will be distributed as liquidity incentives to our valued users. The incentives are set to begin being distributed in June.

Developer Rewards: Developers who integrate our liquidity on Arbitrum will also receive rewards, fostering further innovation and growth within the ecosystem.

We deeply appreciate the overwhelming support from the Arbitrum community and are enthusiastic about working together to enhance trading on the platform.

Looking Forward

With the grant funding secured and strategic partnerships in place, we are entering an exhilarating phase of growth and innovation. Our team is focused on making our platform the premier destination for trading and liquidity provision on Arbitrum. Stay tuned for the exciting updates coming in June!

Thank you for your continued support and engagement. Together, we are shaping the future of DeFi trading and liquidity management.

Stay connected with us on Twitter and Discord for the latest updates and announcements.