Integral Insights March ‘24

Apr 1, 2024

March was a truly special month for us at Integral. Not only did we celebrate our third anniversary, but we also witnessed the return of a significant bull market. During this eventful month, we achieved several important milestones, including a new all-time-high daily volume for Arbitrum and the addition of four new pools on the Ethereum mainnet. None of this would have been possible without the support and dedication of our incredible community. We want to express our heartfelt gratitude to all of you!

Protocol Metrics

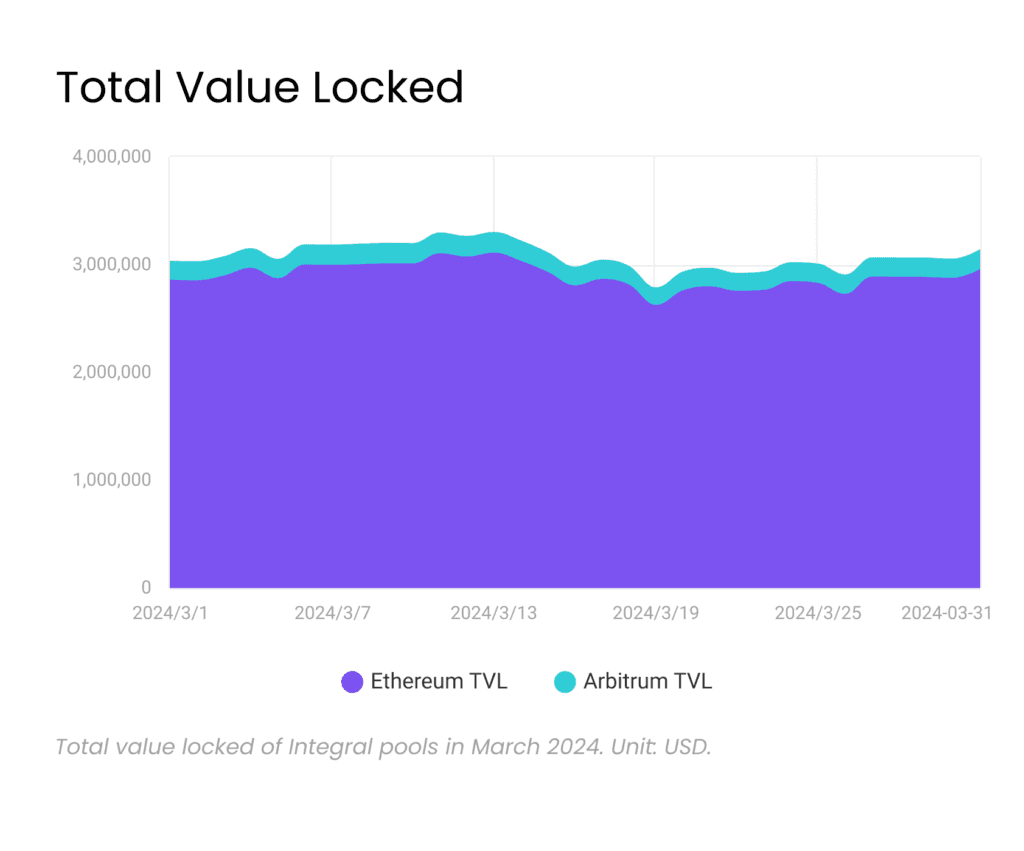

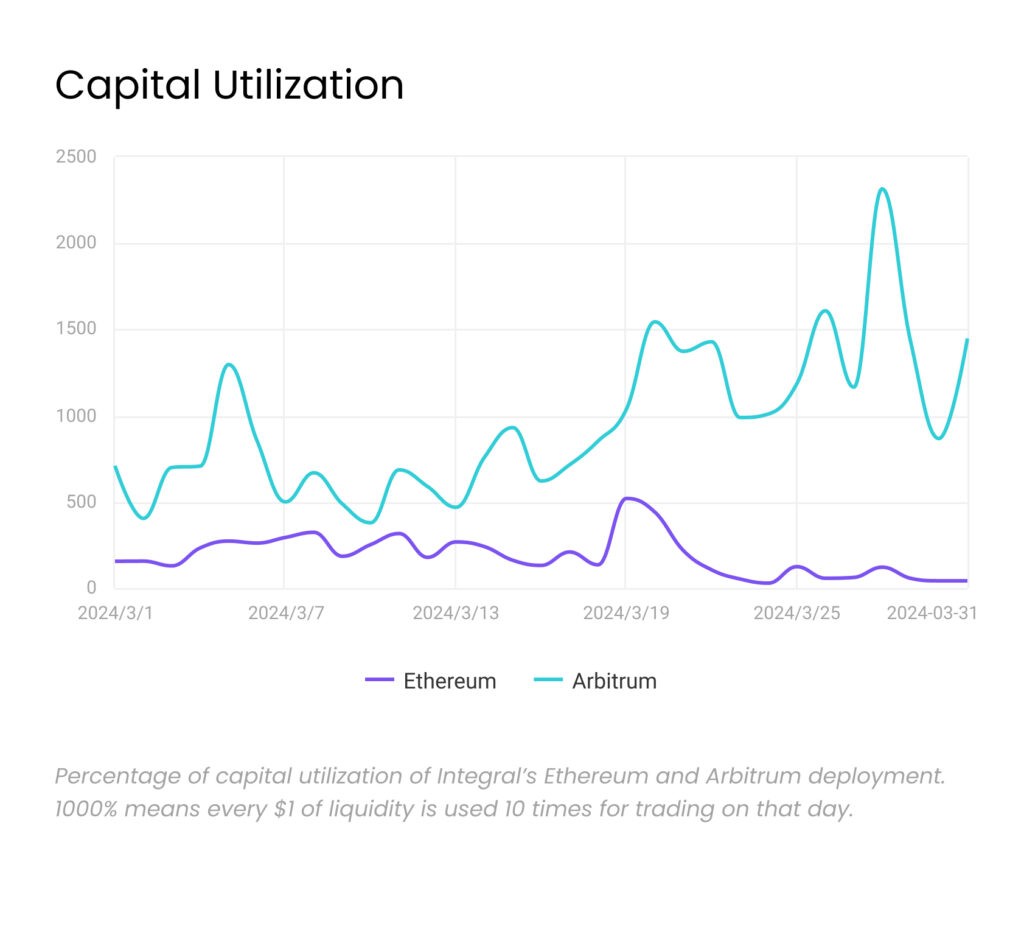

The bull market has driven a substantial volume to Integral, with our average daily volume reaching approximately $7.2 million across Ethereum and Arbitrum combined. This impressive figure highlights the strong trading activity on our platform. By the end of the month, our Total Value Locked (TVL) reached a remarkable $3.14 million, showcasing the growing trust and utility of our protocol within the community.

It's important to note that following the Ethereum mainnet deployment's new ATH daily volume, our integration with 1inch has been affected. Developers from both teams are aware of this issue and are diligently working to resolve it.

Breaking Records: All-time-high Daily Volume

The bull market also brought us two new ATH numbers. On March 20th, the Ethereum mainnet deployment processed $13.6mm, surpassing the previous record of $13.2mm. Similarly, on March 27th, the Arbitrum deployment processed $2.87mm, breaking the previous record of $2.68mm.

Four New Pools

We are excited to announce the addition of four DeFi bluechip token pairs to our Ethereum mainnet deployment. These new pools include WETH-MNT, WETH-UNI, WETH-LINK, and WETH-MKR, further diversifying the options available to our users.

https://twitter.com/IntegralHQ/status/1773647684894908550?s=20

Arbitrum Long-term Incentive Program

We have successfully completed our application for the Arbitrum Long-term Incentive Program (LTIP) with the assistance of our assigned advisors from SeedGOV. The shortlist will be announced on April 3rd, and we eagerly await the results.

For more details on our LTIP application, please visit the Arbitrum Foundation Forum.

Closing Remarks

As we mentioned at the beginning, March marks the third anniversary of the Integral project. We are immensely grateful for your unwavering support. One of our early community members recently reached out to us, saying, "I have been watching and expected that due to the successes, all would be good with the token. For me, it was an invest and forget till next bull run." Rest assured, we will continue to work tirelessly to make Integral the go-to platform for passive concentrated liquidity farming.