Integral Insights Jul '24

Aug 13, 2024

July has been a month of significant milestones and continued growth for Integral. We're excited to share the latest developments and metrics that underscore our progress in reshaping the DeFi landscape.

Integration with 0x Protocol

We're thrilled to announce that Integral is now integrated with 0x protocol on both Ethereum mainnet and Arbitrum! This integration marks a significant expansion of our reach, allowing 0x and Matcha users to tap into Integral's top-tier liquidity. We extend our sincere gratitude to the 0x team and other contributors who made this integration possible.

This partnership not only broadens our user base but also reinforces our commitment to enhancing liquidity across the DeFi ecosystem. By joining forces with 0x, we’re taking another step towards our goal of providing users with an unparalleled trading experience.

Climbing the Ranks: A Top DEX on Arbitrum

Our efforts to establish Integral as a leading DEX on Arbitrum are bearing fruit. We've been recognized twice by @TyranoAnalytics for our impressive trading volumes:

https://twitter.com/TyranoAnalytics/status/1817727625978142769

These achievements reflect the growing adoption of Integral's passive concentrated liquidity model and underscore our competitive edge in the Arbitrum ecosystem.

Arbitrum Long Term Incentives Pilot Program

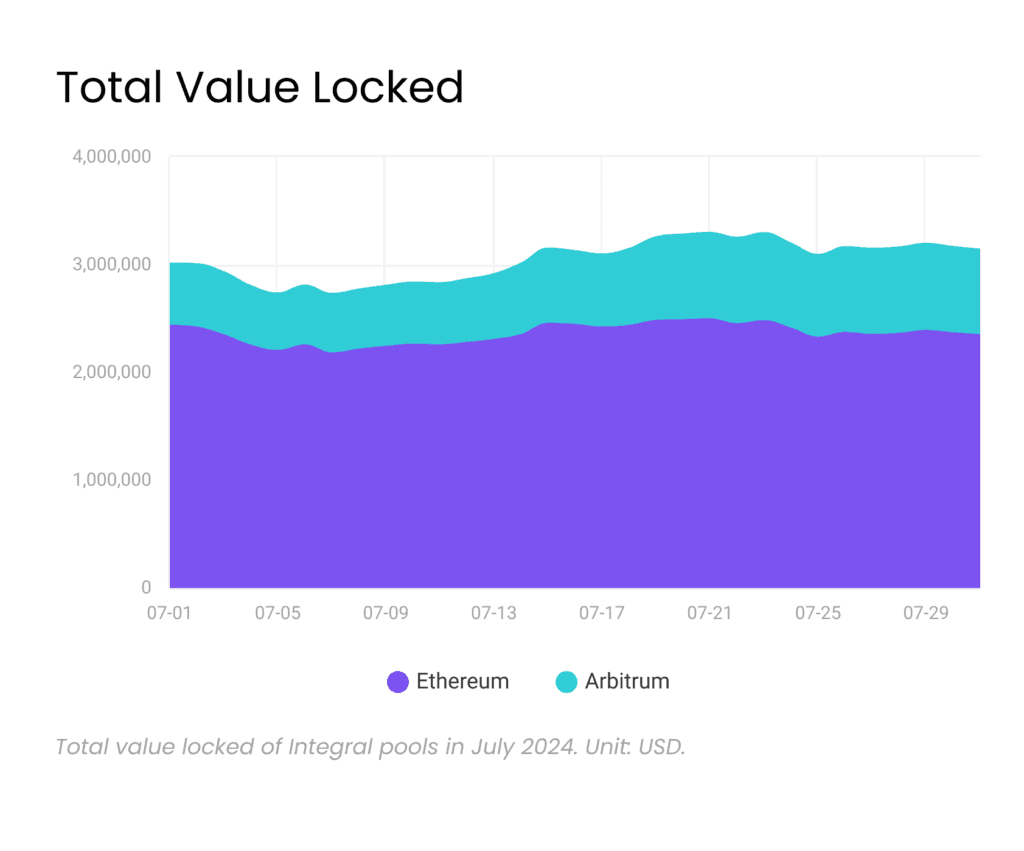

The Arbitrum Long Term Incentives Pilot Program continues to drive engagement on our platform. We’ve observed that the Total Value Locked (TVL) on Arbitrum has remained elevated, thanks in part to the incentive program.

Attractive Yields on Arbitrum Pools

Our Arbitrum pools continue to offer compelling yields for liquidity providers. Here are the 30-day average APRs for each Arbitrum pool:

WETH-WSTETH: 28.22%

WETH-USDC: 71.84%

WETH-USDT: 80.68%

WETH-ARB: 141%

WETH-USDC.e: 32.57%

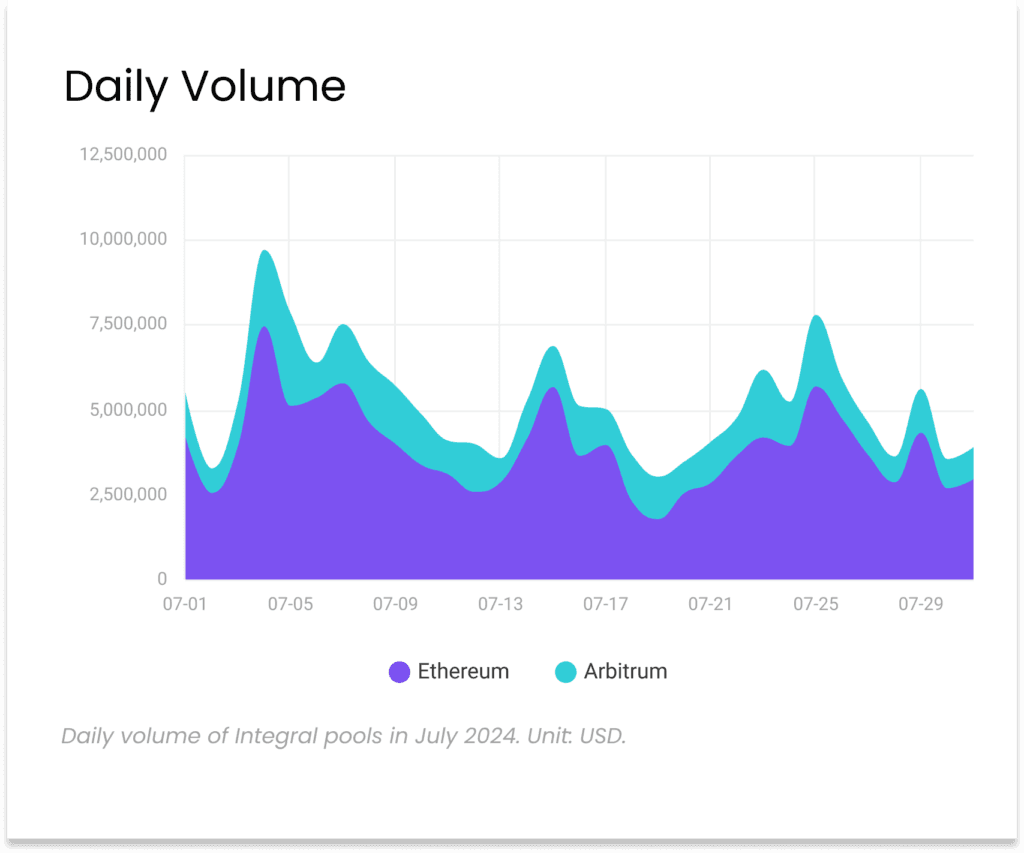

These attractive yields demonstrate the efficiency of our passive concentrated liquidity model and highlight the value proposition for liquidity providers on our platform. Below are some key stats for each network:

Total Volume for Ethereum: 120,327,628.35

Total Volume for Arbitrum: 41,312,402.67

Liquidity Utilization for Ethereum: 50.90

Liquidity Utilization for Arbitrum: 60.34

Looking Ahead

As we move into August, we're focused on leveraging our recent integrations and rankings to further expand our user base and liquidity pools.

Stay tuned for more updates, and as always, we welcome your feedback and suggestions. Join us on our journey to revolutionize DeFi trading and liquidity provision.

Thank you for your continued support and trust in Integral.

Connect with us on Twitter and Discord for real-time updates and community discussions.