Integral Insights Aug '24

Sep 11, 2024

Arbitrum Incentives Program Analysis

As we conclude August, we're excited to share a comprehensive review of our Arbitrum incentives program and overall market performance. This month has been noteworthy, showcasing the strength of our passive concentrated liquidity model and the positive impact of our ARB token distribution.

Key Metrics Overview

Let's start by comparing the key metrics from the beginning of the program to our most recent data:

Average Daily TVL

Jan 1 - June 2, 2024: $68,316

June 3 - Aug 31, 2024: $116,887

Change: +71%

Average Daily Transactions

Jan 1 - June 2, 2024: 585

June 3 - Aug 31, 2024: 868

Change: +48.4%

Average Daily Volume

Jan 1 - June 2, 2024: 1,632,124.4

June 3 - Aug 31, 2024: 1,428,765.65

Change: -12.4%

Incentives Impact

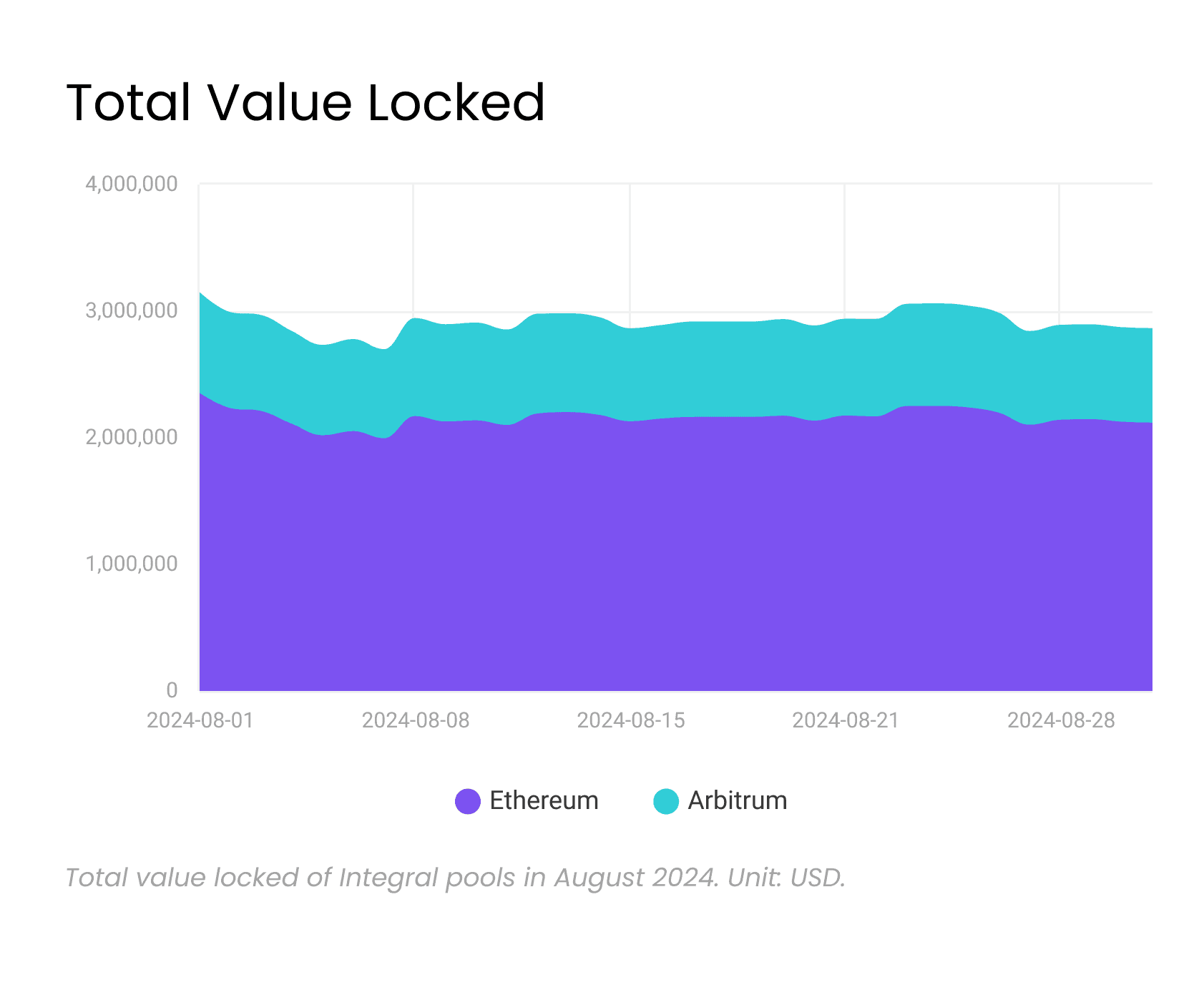

Total Value Locked (TVL) We've seen a remarkable 71.1% increase in average daily TVL since the program's start. This substantial growth demonstrates the effectiveness of our incentives in attracting liquidity.

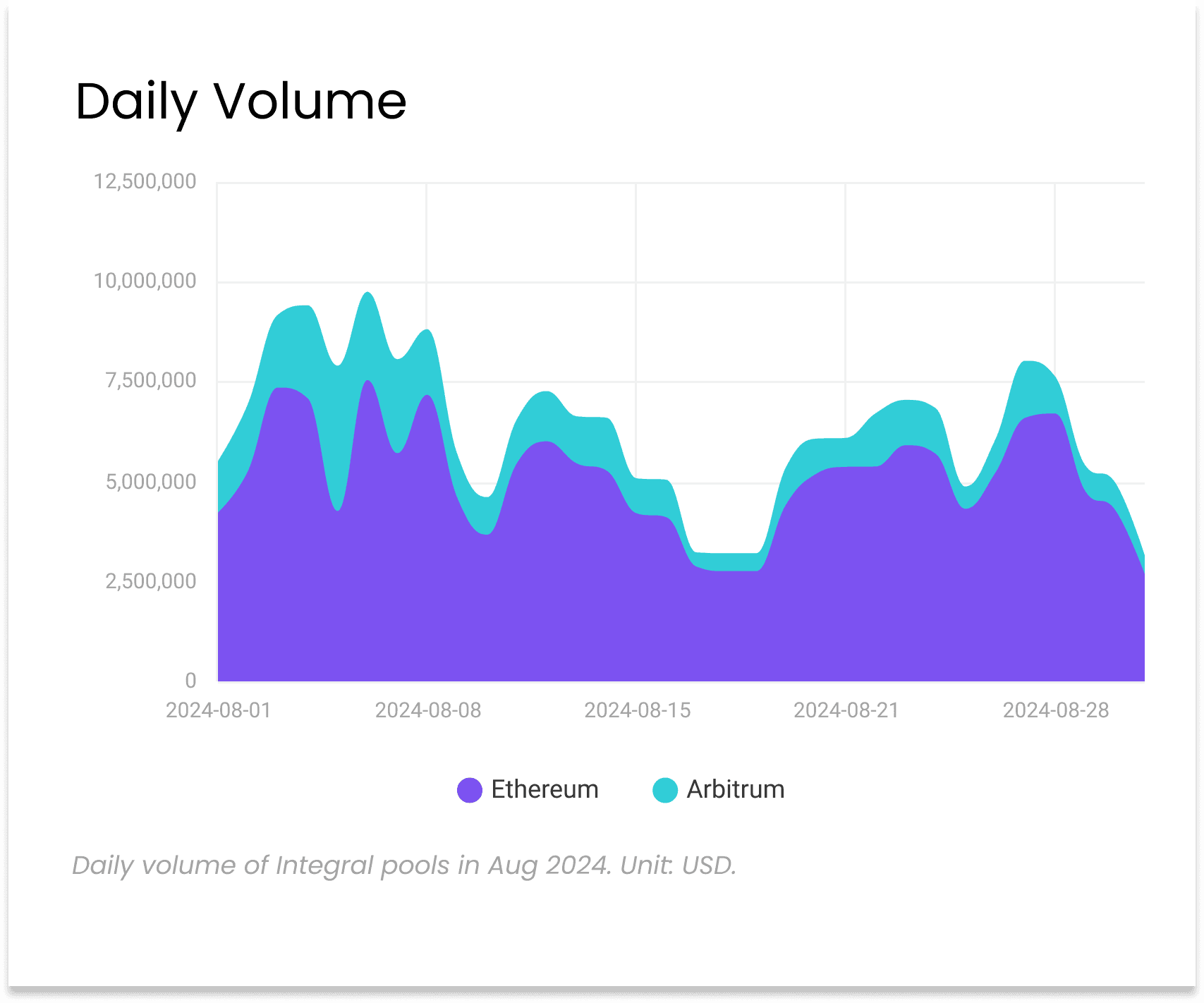

Transaction Volume Our average daily transactions have increased by 48.4% since the program's inception, indicating that the increased liquidity has translated into more trading activity.

User Engagement Prior to the incentives program, we averaged 13 unique users per day. Since the program's start, this has grown to an average of 16 unique users daily, representing a 23.1% increase. This growth in our user base is a strong indicator of the program's success in attracting and retaining traders and liquidity providers.

Ethereum Metrics

Market Recognition and Composability

Our efforts in enhancing liquidity and providing competitive pricing are gaining recognition in the broader DeFi ecosystem. A notable mention came from Phil Liao (@philipliao_) on August 11th, highlighting a large trade on Matcha that utilized multiple AMMs, including Integral, to deliver elite pricing. This showcases the power of composability in DeFi and Integral's role in providing deep liquidity and competitive quotes.

Integral's Position in the DEX Landscape

The provided image illustrates Integral's position among other major DEXs for a $2.08M trade on Ethereum. While Uniswap V2 and V3 account for a decent portion of the liquidity, Integral is visibly present, contributing to the overall liquidity pool for this large trade. This visual representation underscores our growing importance in the DEX ecosystem, particularly for substantial trades where deep liquidity is crucial.

Conclusion

The August review reveals strong performance across our key metrics, with our passive concentrated liquidity model delivering impressive APRs. The Arbitrum incentives program has significantly boosted our TVL and transaction volume, setting a solid foundation for future growth.

Moving forward, we'll focus on:

Attracting new users to capitalize on our high APRs and deep liquidity

Expanding our integrations with other DeFi protocols to enhance our visibility and utilization

Continuing to provide elite pricing and deep liquidity for large trades, cementing our position as a go-to DEX for significant transactions

We're excited about our progress and the recognition we're receiving in the DeFi space. As we continue to innovate and grow, we remain committed to providing unparalleled value to our liquidity providers and traders.

Stay tuned for more updates, and don't forget to explore our high-yield opportunities at app.integral.link/pools.