How to Save Money in DeFi

Jul 22, 2023

None of the information contained here constitutes an offer (or solicitation of an offer) to buy or sell any currency, product or financial instrument, to make any investment, or to participate in any particular trading strategy.

With opportunities come risks, and DeFi is no exception. In this blog post, we’ll guide you through effective strategies on how to save money in DeFi while mitigating potential risks.

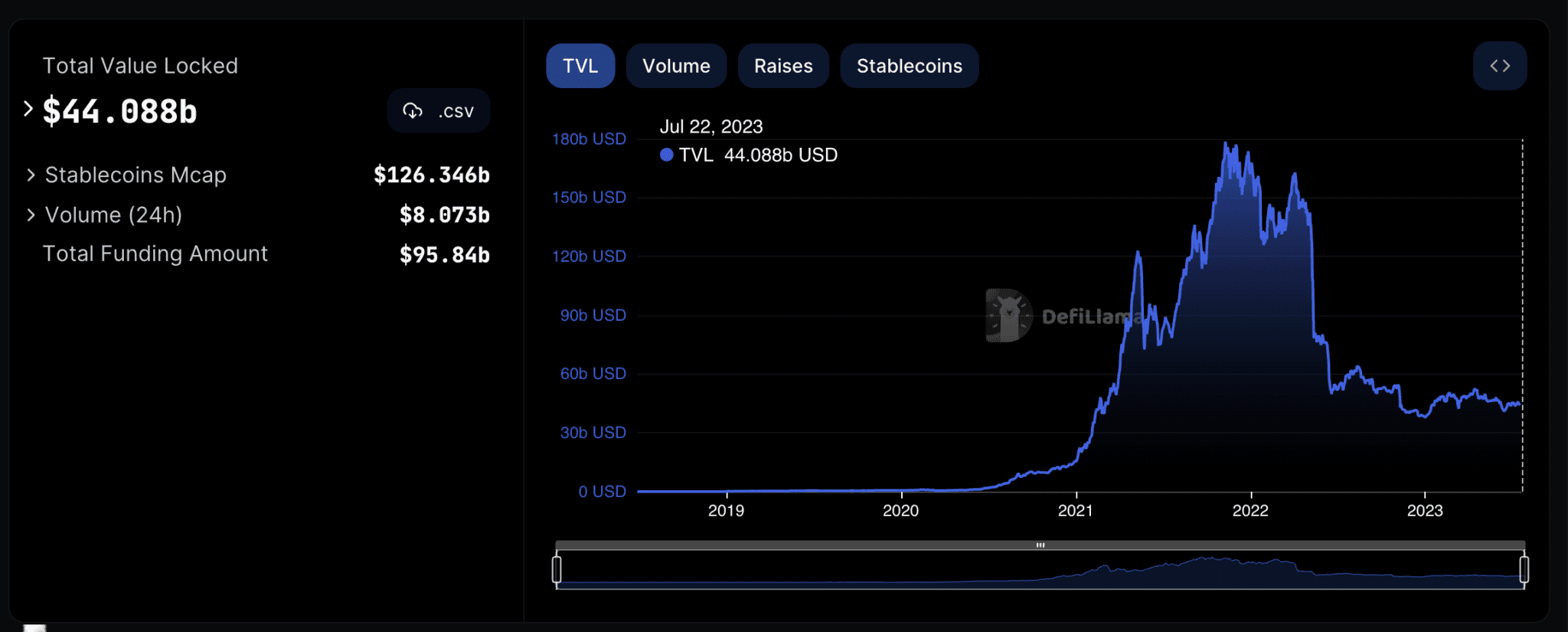

DeFi leverages smart contracts on blockchains, most commonly on Ethereum. Though volatile, DeFi can offer a good venue to make returns on tokens and stablecoins. The total value locked (TVL) in DeFi applications has reached over $85 billion, a testament to its growth and potential.

Here are some ways to save money when using DeFi applications to get the most bang out for your buck.

Do Your Homework

The first step in saving money in DeFi is to educate yourself. Understanding how DeFi protocols work is crucial. Remember that high yields often come with high risks. Research the project’s team, check the smart contract audits, and don’t get swayed by hype. Reliable sources like DeFi Llama, CoinGecko, and Etherscan can help you assess the credibility of DeFi projects.

Diversify Your Investments

Just like traditional investments, diversification is crucial in DeFi. Don’t put all your eggs in one basket. Instead, spread your funds across different protocols to minimize risk. From yield farming and liquidity pools to lending platforms, there are numerous ways to earn passive income in DeFi. But eve protocols that seem safe can still have vulnerabilities and high returns aren’t going to make up for loosing all of your capital.

Watch Out for Gas Fees

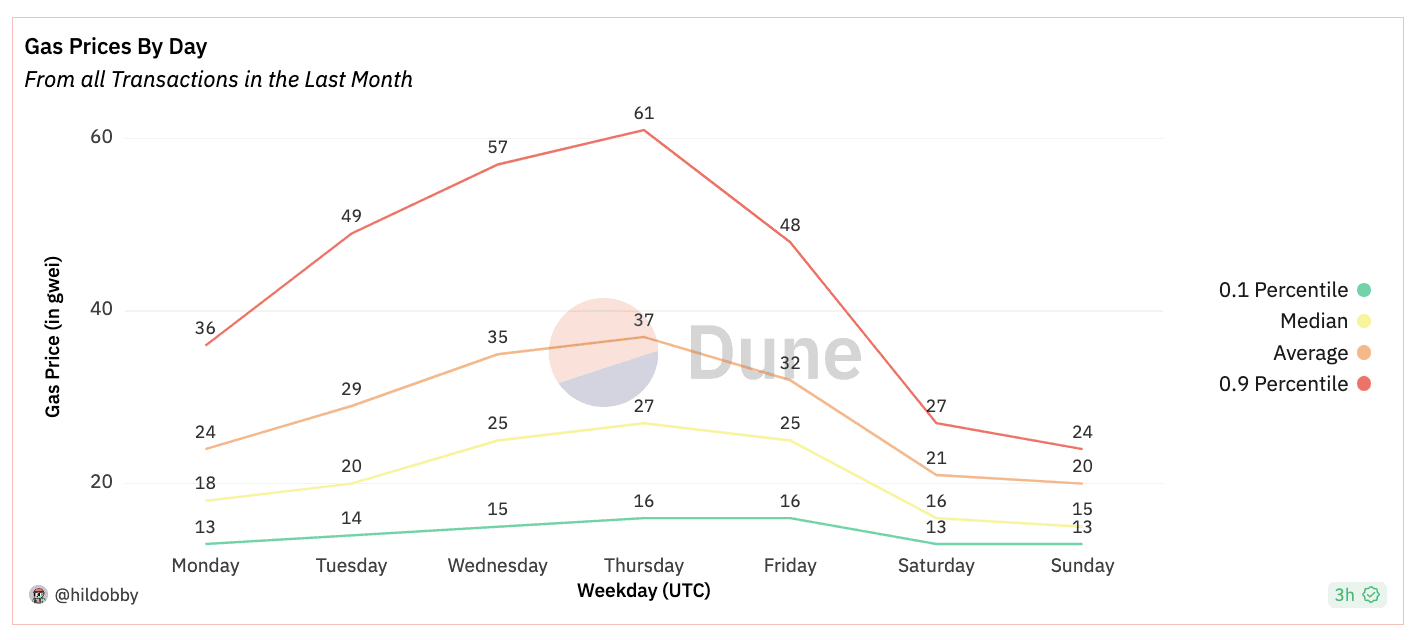

High transaction (or ‘gas’) fees on the Ethereum network can eat into your earnings, especially when the network is congested. Monitor gas prices using tools like Etherscan before making any transactions. In some cases, waiting for gas prices to lower could save you a considerable amount of money. Typically, weekends and lower-activity times like holidays offer the best chance to get transactions submitted for cheap. If transactions aren’t time sensitive, you can also submit them with low gas costs and they will be included once the network gas costs come down.

Utilize Insurance Options

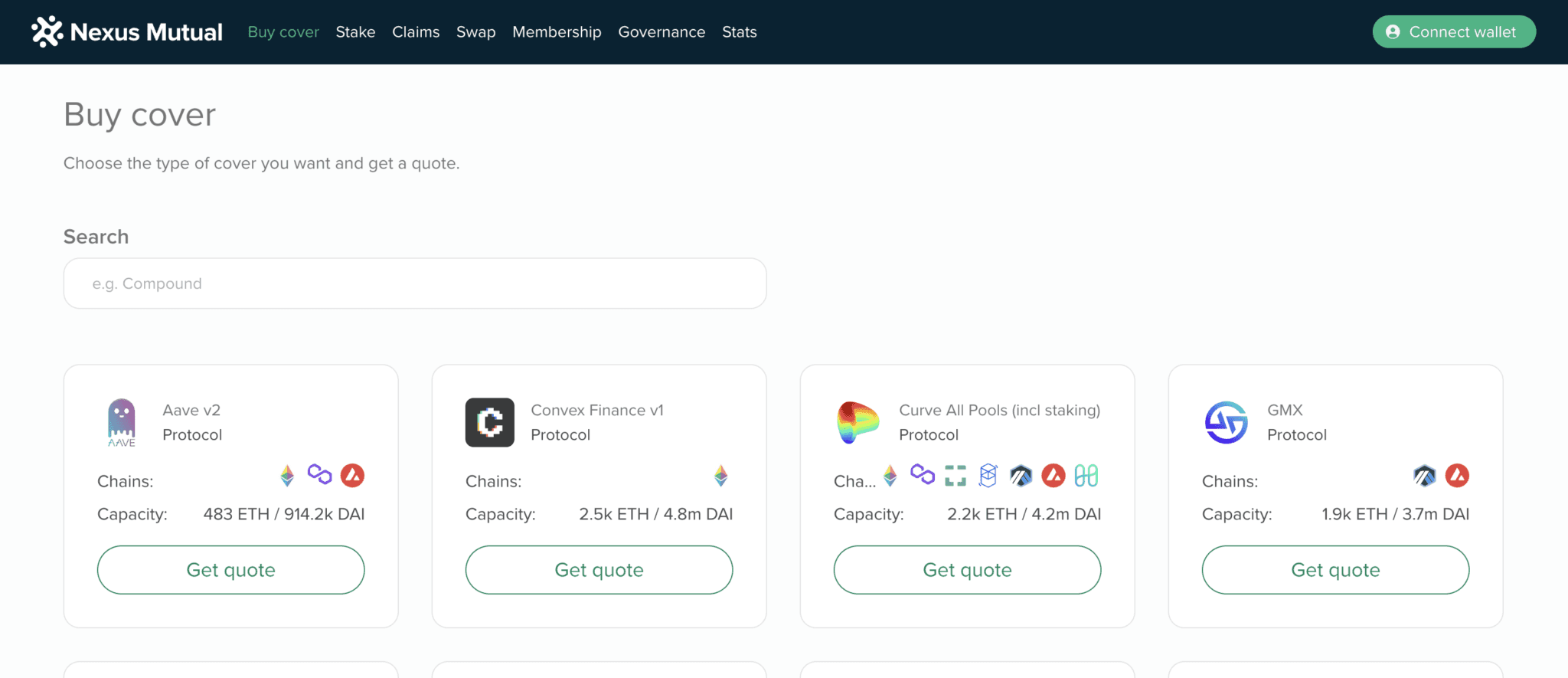

As DeFi operates in a “permissionless” way, it opens the door to potential hacks and exploits. Protecting your investment with DeFi insurance platforms such as Nexus Mutual can be a wise move. These insurance options can cover smart contract failures, helping to safeguard your funds. While DeFi insurance is still early and expensive, it can offset a lot of the smart contract risk and is not always more than the earned yield in a protocol. There are some protocols that buy insurance for themselves or offer protection through an audit service like Sherlock.

Keep Track of Your Investments

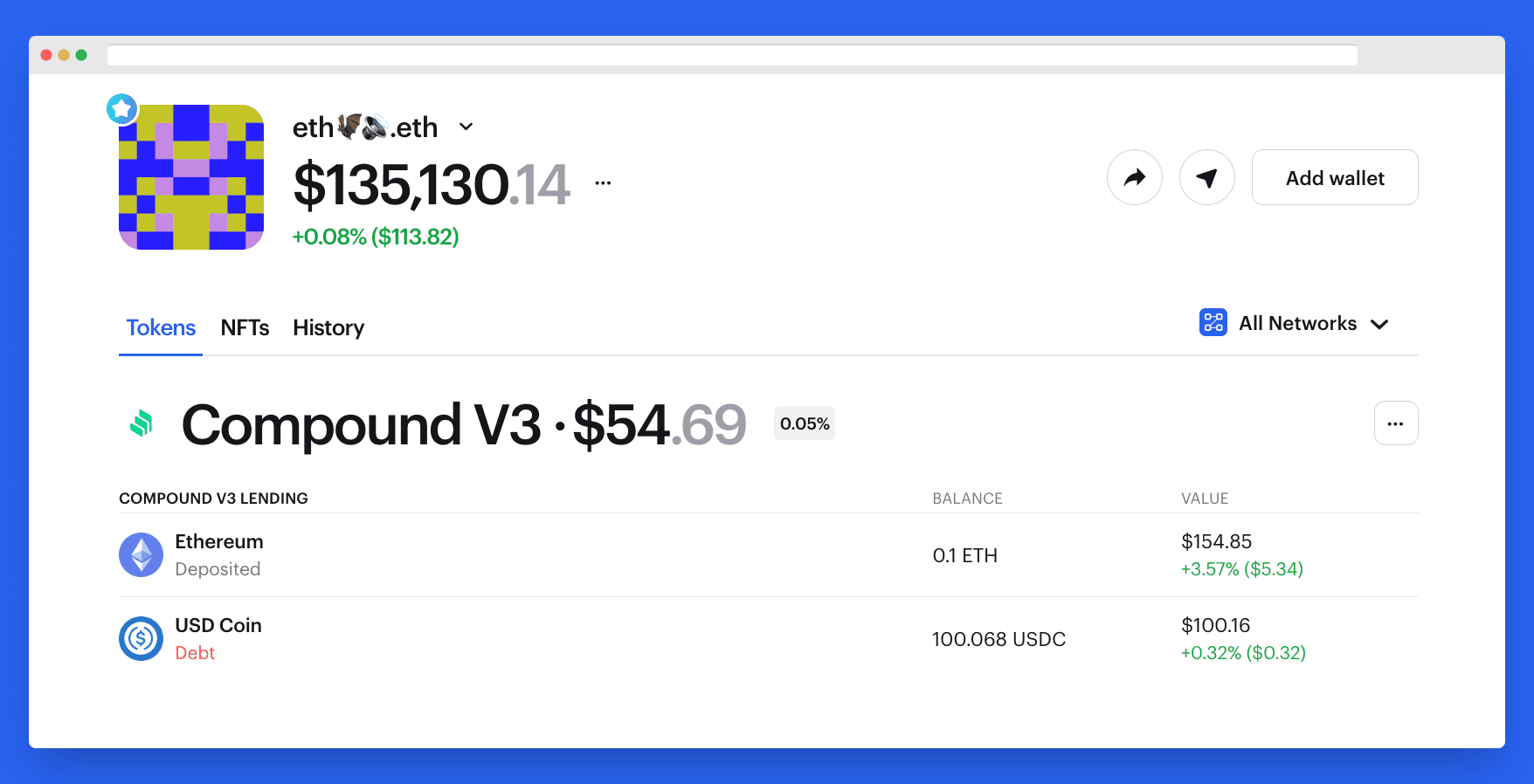

Regularly monitoring your investments is a must. Tools like Zapper or DeBank can provide a clear overview of your DeFi portfolio, helping you understand your returns, manage your risks, and identify opportunities to save more effectively.

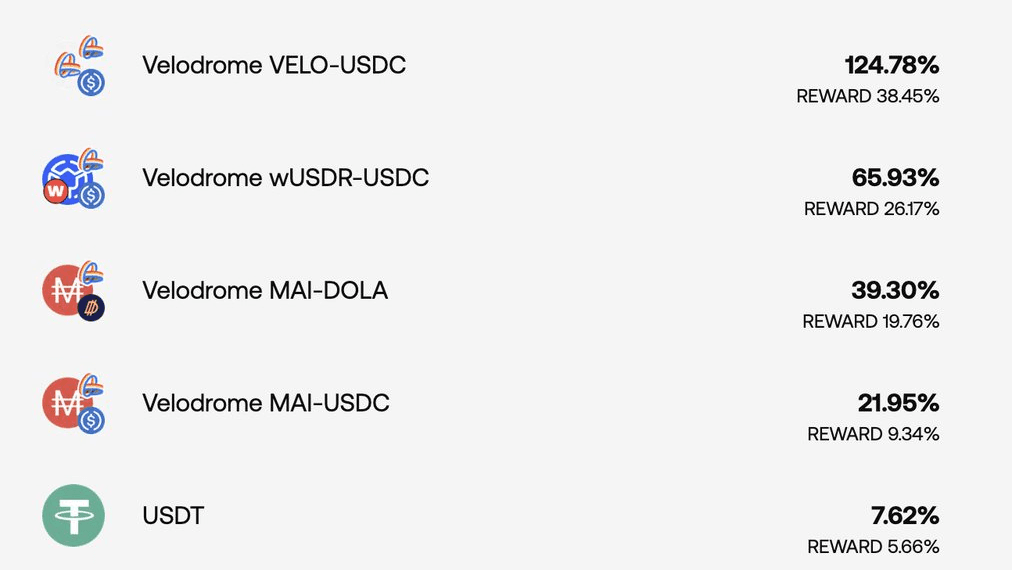

Take Advantage of Yield Aggregators

Yield aggregators can help maximize your returns and save money in DeFi. These platforms, such as Yearn, use complex strategies to automatically shift your funds between the most profitable DeFi protocols, helping you achieve the best possible return on investment. They also socialize gas costs, making them ideal for longer term investments in smaller amounts. While aggregators tend to take fees, it is often less than the costs of managing a dynamic yield strategy on your own.

Conclusion

The DeFi landscape is continually changing and brimming with opportunities. By following the tips outlined in this article, you can navigate this dynamic space more effectively, saving money, and potentially reaping substantial rewards.

Remember, the key to successful investing in DeFi, as with any other form of investment, lies in understanding the risks, diversifying your portfolio, and staying updated with market trends. See you on chain!